| Economic articles

Advisor Mustafa Al-Manea wrote: “At last, the U.S. Federal Reserve has cut interest rates by 25 basis points.”

In a move reflecting the flexibility of U.S. monetary policy, the Federal Reserve, led by Jerome Powell, decided to reduce interest rates by 25 basis points, bringing them to a range of 4.00%–4.25% from 4.25%–4.50%. This step confirms that the world’s largest economy continues to prioritize growth and financial stability, and remains ready to use its tools to support both domestic and global markets.

A rate cut means easier financing for households and businesses, which stimulates economic activity, boosts consumption, and opens the way for greater investment expansion. This dynamic strengthens the labor market and preserves the appeal of the U.S. economy. The relative decline in the value of the dollar also enhances the competitiveness of American exports, reinforcing the U.S. position in global trade.

The decision positively impacted global investor confidence. A weaker dollar eases debt burdens denominated in U.S. currency for many developing countries, while liquidity inflows into emerging markets encourage new investments. As the global economy gains momentum, forecasts for international trade and commodity prices—especially energy—improve.

Positive Implications for Libya

For Libya, the U.S. rate cut could bring encouraging effects on multiple fronts. Any improvement in the global economy translates into higher demand for oil, thus boosting Libyan oil exports. The timing is favorable for the Government of National Unity’s plan to increase oil and gas production in line with global market conditions. It also provides an opportunity to strengthen foreign investment partnerships in oil, gas, mining, and other sectors, given the stimulative effect of lower rates on foreign investments. Additionally, greater global market stability supports steadier import prices, easing pressure on domestic purchasing power.

Although Libya’s monetary policy is not directly tied to Federal Reserve actions, the opportunity lies in leveraging this new economic cycle by increasing oil output and channeling revenues into developmental and investment projects that foster diversification and long-term stability.

Impact on the Gold Market

One of the most immediate effects of the rate cut has been seen in gold prices. Gold, as a safe-haven asset, becomes more attractive when yields on cash assets fall and the dollar weakens. Currently, the price of gold stands at around $3,680 per ounce, after recently touching a record $3,704.95 per ounce. Deutsche Bank forecasts that gold prices could reach $4,000 per ounce by 2026, driven by sustained central bank demand and an expected weaker dollar.

This surge reflects investor confidence in gold as a hedge, suggesting continued investment inflows into the sector. For economies reliant on gold and oil exports, such as Libya, this is an added boost. The rise in gold prices positively affects the market value of Libya’s gold reserves, estimated at about 147 tons.

Conclusion

The U.S. decision to cut interest rates by 25 basis points is not merely a technical monetary measure, but a clear signal that the United States is working to stimulate global growth and markets. For Libya, this moment represents an opportunity to maximize benefits from higher oil and gold prices, reinvest revenues in building a more resilient and diversified economy, and open a pathway toward greater stability and prosperity—if managed wisely.

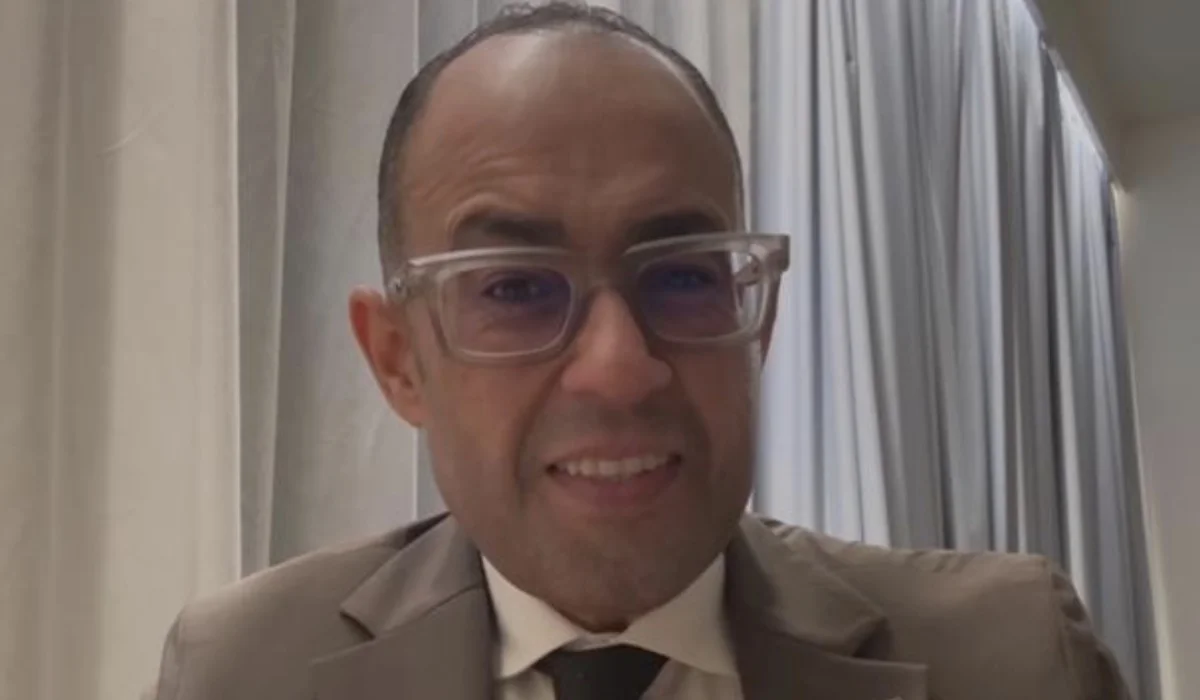

About the Author

Mustafa Al-Manea is a Libyan lawyer and legal-economic expert with over 23 years of experience. He has worked with investment institutions, sovereign funds, and banks in Libya and abroad, served as an advisor to the Central Bank of Libya, and held positions on the boards of the Libyan Investment Authority and the Libyan Foreign Bank. He has represented Libya in meetings of the World Bank and IMF, and currently chairs the executive team for the Prime Minister’s initiatives and strategic projects. He is also a member of the Libyan-American Council for Trade and Investment and has authored numerous articles in Arab, American, and European publications.