| News

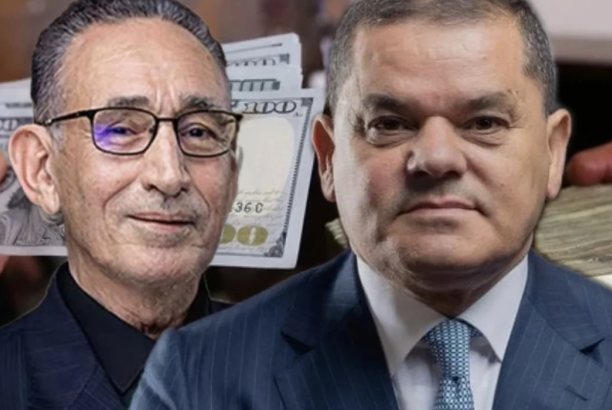

Al-Barghouthi Writes: “Why the Insistence on the Story of Selling Gold?! What Lies Behind the Gold Revaluation”

Written by economics professor Mohamed Al-Barghouthi:

Why insist on the story of selling gold?! What lies behind the gold revaluation.

After the Central Bank of Libya carried out a revaluation of gold—not selling part of its gold reserves, as has been circulated—there was widespread uproar due to the promotion of the false narrative of selling gold. This narrative is full of gaps, non-accounting statements, and claims far removed from economic reality. Incidentally, a revaluation of assets such as gold is a normal and routine accounting procedure performed by all central banks worldwide, yet there is significant curiosity about the reasons and objectives behind these claims.

The process of revaluing gold reserves is primarily a technical step with an accounting and financial dimension, but in reality, it is a political and economic message directed at several stakeholders: domestically, local markets, and international institutions. Below is a neutral reading of the objectives and details of this procedure at the Central Bank of Libya, based on publicly announced sources.

1. What actually happened?

The bank recently carried out a revaluation of its gold reserves, which resulted in a notable increase in the book value of the reserves. The Article IV consultation report indicated a revaluation of approximately $10.5 billion in 2024, based on the price per ton of gold during the same period.

Official figures and international indicators also recorded a historic high in the declared gold quantity (around 146.65 tons), after additional purchases or entries were recorded in mid-2023.

2. Accounting message versus dollar liquidity message

The revaluation is fundamentally an accounting procedure that increases asset value on the balance sheet, but it does not create immediate hard-currency liquidity unless slow, deliberate liquidation decisions are made. Practically, the total increase boosts solvency indicators and gives the bank a higher confidence rating on paper, but it does not mean sudden availability of dollars in the market to pay for imports or current obligations. This distinction is crucial for interpreting the bank’s messages to the market.

3. Political and economic message

- Internal message: It aims to reassure citizens and local institutions that the bank has a strong safety net in reserves, potentially reducing psychological pressure on foreign currency demand.

- External message: It signals to international institutions (IMF, correspondent banks, investors) that Libya’s external solvency position is improving, which may ease negotiation conditions or strengthen the country’s position in technical reviews.

4. Between the lines and risks

- Some parties seek political monetization of gold, and the risk of liquidating gold for financing purposes remains, as it may lead to price losses or hasty, less wise decisions under dollar liquidity pressure.

- Governance and transparency: The effectiveness of the intended message depends on the credibility of procedures, including frequency of disclosures, evaluation methodology, and independent auditing, which increase public and institutional trust. Conversely, lack of methodological clarity raises doubts about the durability of results.

5. Implications for monetary and fiscal policy

- The revaluation provides a stronger basis for central arguments against printing new currency: it gives the bank grounds to demonstrate reserve solvency instead of reducing solvency solely to circulating money.

- However, it does not eliminate the need to control spending and prioritize the budget, as improved paper solvency does not prevent inflationary pressures if deficits continue to be financed in cash.

6. What should be done at this stage?

- Publish the evaluation methodology, announce standards (reference price or monthly average), and evaluation periods to increase credibility.

- Avoid succumbing to requests for liquidation and usage, and set a written policy specifying the strict conditions under which a very small portion of gold can be liquidated in phases (conditions, approvals, alternatives) to prevent turning the asset into temporary support under economic pressure.

- Link the messages to reform calls, accompany revaluation announcements with a roadmap for public finance reform so that it is not just an accounting statement without real impact.

In general:

Gold revaluation in Libya is a necessary measure to enhance solvency indicators and send reassurance signals, but fundamentally, it is an accounting procedure that will not become an effective force unless paired with organized monetary and fiscal policies, transparent standards, and clear governance procedures. Reading behind this step reveals that the bank’s main message is: “We have a substantial reserve,” but the more important question remains: how will this weight be translated into effective protection for the economy and citizens?