| News

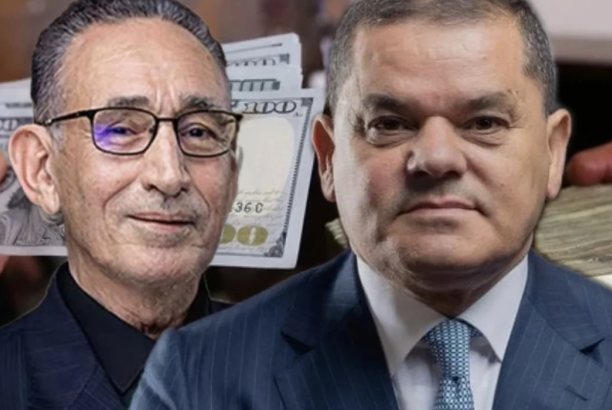

Naji Issa: “The Banking Sector Is Under Pressure… And This Is What Will Happen If We Don’t Raise Citizens’ Purchasing Power”

The Governor of the Central Bank of Libya, Naji Issa, stated regarding the Banking Investment Initiative that it is not necessarily meant to be implemented next month, but rather to be ready as part of a broader vision. He emphasized that without a comprehensive economic vision aligning all policies and defining real objectives, such a project cannot achieve its goals. “The Central Bank’s initiative is one we are ready for today — a prepared document and project — but without restructuring and reforming Libya’s economy, no initiative will achieve its purpose. The Central Bank cannot operate independently in all areas, even in monetary policy,” he said.

Issa added: “Without the oil sector, we have no economy. We have initiatives, and the private sector is striving, but it faces many challenges. If oil prices drop to $52 per barrel, the state won’t be able to pay salaries. We must ask: What will Libya’s economy look like in the next three years? Will the state continue employing more than 2.5 million people in the public sector and spending 80 billion on salaries at the expense of development funding?”

He further noted that while government development projects have added value, they are not productive value-added projects and thus cannot be financed by the Holding Company. The credit extended by banks — often seen as consumer loans — actually covers citizens’ income deficits, since incomes have remained low for decades. “If we do not increase citizens’ purchasing power, private sector investments will not find the demand needed to consume the goods and services produced. Stimulating credit and purchasing power is what drives growth itself,” Issa explained.

He continued: “The banking sector is fulfilling its role, though there are shortcomings — not due to the Central Bank, but because of the circumstances we face. The situation and environment are not ideal for designing monetary or economic policies.”

Issa also pointed out that he is working with two governments — not by choice, but as a reflection of reality on the ground. “The Ministry of Economy is divided, the Ministry of Finance is divided, and so are all state institutions. How can we establish a Holding Company and launch it next month amid this division? Even political division has imposed a reality on the Central Bank. Everyone blames the banking sector and the Central Bank, but there are no magical solutions without a unified vision and functioning state institutions,” he said.

He revealed that the state currently needs around $3 billion based on current spending rates, while net revenues deposited in the Central Bank may not exceed $1.5 billion, posing a major fiscal challenge.

Issa concluded: “We have demands from traders, the private sector, and banks. We all hope that problems will be solved and citizens can live in prosperity — this is our goal and the government’s goal — but the current reality limits these solutions. The banking sector and the Central Bank are under pressure, yet hope remains in the initiatives that will soon be implemented.”