| News

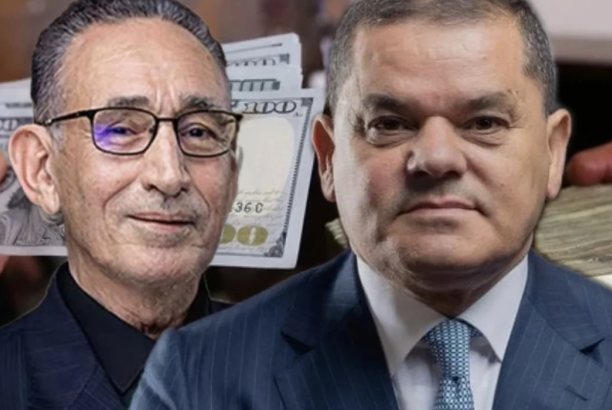

Husni Bey Attacks Monetary Policies: “It’s Time for a Bold Decision to End Currency Chaos and Speculation”

Libyan businessman Husni Bey revealed to our source in an exclusive statement: “Since 1971, the world has faced a fundamental economic question that remains unresolved: is currency a means of exchange or a commodity subject to market laws? International experience has shown, without exception, that after abandoning the gold standard, currencies are no longer guaranteed means of exchange as before, but rather commodities whose real value depends on the strength of the issuing economy, not on any administrative or theoretical decision.”

He added: “In Libya, the situation today is even more complex and dangerous, with multiple exchange rates creating a completely distorted monetary system:

- Official dollar rate

- Parallel market rate

- Rate via certificates (sukuk)

There are stark differences between the cash value of the dinar and its value when using certificates.”

He continued: “Despite this chaos, some economists still insist that currency is merely a ‘means’ and that its rate can be fixed by government decree, ignoring that this price has no relation to its real value, purchasing power, or market reality.”

He said: “The natural outcome of insisting on this illusion is that the currency has become the largest speculative market in Libya, guaranteeing profits of at least 20% in cash for those obtaining dollars at the official rate, and up to 45% through certificates. This huge gap creates and encourages exploitation, resulting in bank employees being prosecuted and imprisoned every ten hours throughout an entire year.”

According to Husni Bey, the price gap is not only an economic phenomenon but also a systematized corruption framework, arising from rigid monetary policies that refuse to face reality. Seven decades of experience have proven that fixed exchange rate policies have failed miserably: the dinar, which was equal to $3.30 in 1982, has lost over 95% of its value today, with one dollar exceeding 7,000 dinars in some transactions.

He added: “Based on this, I pose a critical question to the state and decision-makers:

- When will it be acknowledged that current monetary policies have exhausted all opportunities and failed?

- When will a bold and courageous decision be made to reform the exchange system and cancel policies that decades of experience have shown only deepen the gap, encourage speculation, and fail the national economy?”

He concluded: “Continuing this approach is no longer merely an economic error but a direct threat to the stability of the state, its economy, and the future of its generations.”