| News

Exclusive: Al-Qaryo: The Performance of the Libyan Investment Authority Cannot Be Assessed by the Standards of Funds Operating Without Constraints

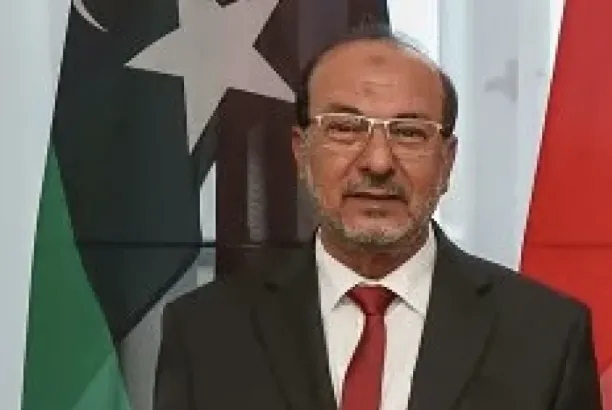

Louay Al-Qaryo, advisor to the Libyan Investment Authority, told our source in an exclusive statement that there is a clear contradiction in the posts of some colleagues, which necessitated clarifying the picture to the public.

Al-Qaryo explained that it is illogical to claim weak efficiency in asset management while the assets of the Libyan Investment Authority are subject to an effective freeze and strict constraints. He questioned the basis on which the Authority’s performance is compared to the growth rates of global sovereign funds operating under normal conditions, while the Libyan Investment Authority operates in a fully constrained environment.

He noted that the contradiction lies in simultaneously supporting the option of maintaining the asset freeze as the most appropriate course at the current stage, and then returning to compare profits and returns with other sovereign funds that face no legal or operational restrictions.

Al-Qaryo also raised a fundamental question regarding the evaluation mechanism, asking how fair it is to hold the current management accountable for companies and investments inherited more than twenty years ago—investments that have proven unviable since their inception—at a time when the Authority is prohibited from selling, disposing of, or restructuring these assets, yet is still expected to achieve profitability.

Despite these constraints, Al-Qaryo affirmed that the Libyan Investment Authority has achieved unprecedented accomplishments in Libya—despite the freeze, not because of it. He said the Authority prepared consolidated financial statements in accordance with international accounting standards, becoming the only entity to accomplish this, in addition to introducing best practices in governance and corporate management.

He added that the Authority obtained an exemption from the United Nations Security Council to manage its assets starting this year, reflecting a high level of international confidence in its performance, and that its financial statements have been audited by an independent international firm.