Professor of Economics at the Libyan Academy, Dr. Omar Zarmouh, stated in an interview with our source, commenting on the speech of the Governor of the Central Bank of Libya, number (11/1201), addressed to the Prime Minister of the National Unity Government on 2024/03/21: The Governor’s speech addressed a number of important and intriguing economic issues that deserve attention and discussion. Below, we address these issues within the framework of what we believe serves the interests of the Libyan economy.

First: The issue of diversifying sources of income and achieving economic development in the 1950s before the discovery of oil in Libya. American economist Benjamin Higgins once said about Libya that economists no longer need to search for a theoretical model for poverty and underdevelopment, as Libya gathers within its borders all the elements of poverty and underdevelopment that can be found anywhere in the world. After listing the most important of these elements, he said: “If Libya can be led to sustainable economic growth, there is hope for every country in the world.” With these harsh words, the real description of the Libyan economy’s reality was the day after independence and before the discovery of oil. As harsh as the words and reality were, the challenge for the true sons of Libya should have been to embark on the battle for economic development. What happened? Oil was discovered and exported starting from the last quarter of 1961, and Libya then overcame one of the biggest obstacles that could have hindered its progress towards achieving economic development, by providing a source of financing.

He added: Indeed, the Libyan state adopted and implemented the First Five-Year Plan 1963-1968, which focused on the infrastructure of the economy. This plan was indeed the first wonderful step in a long path leading to diversifying the components of the gross domestic product and then diversifying sources of income and achieving economic and social progress in all fields. Has this long path continued or has it been interrupted, hindered, and failed?

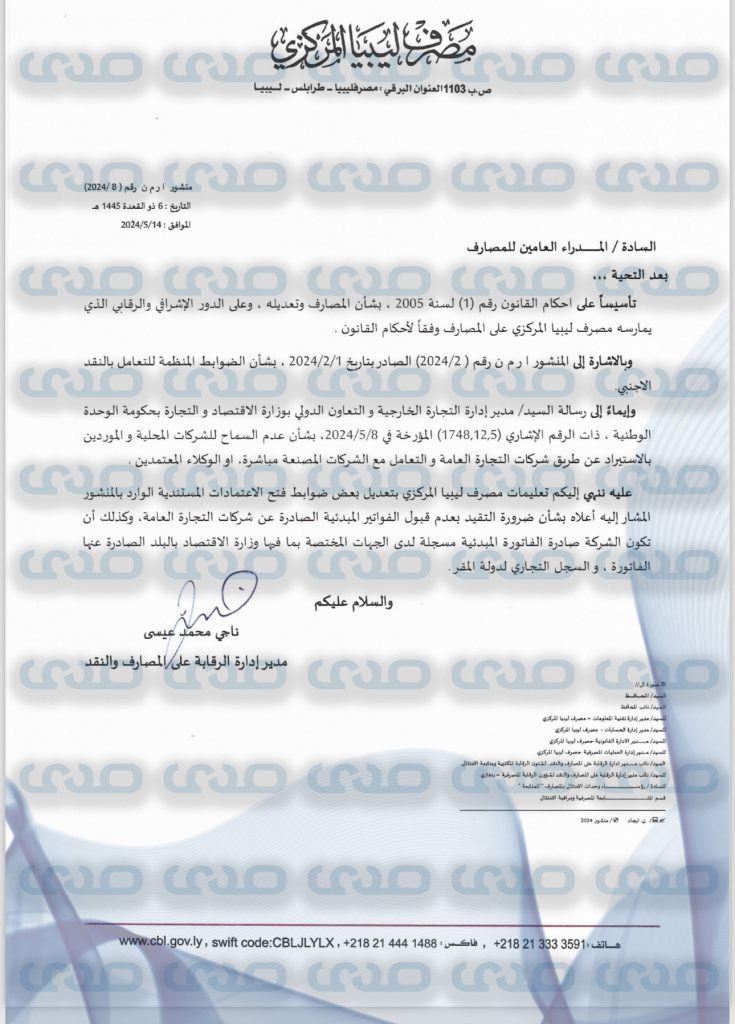

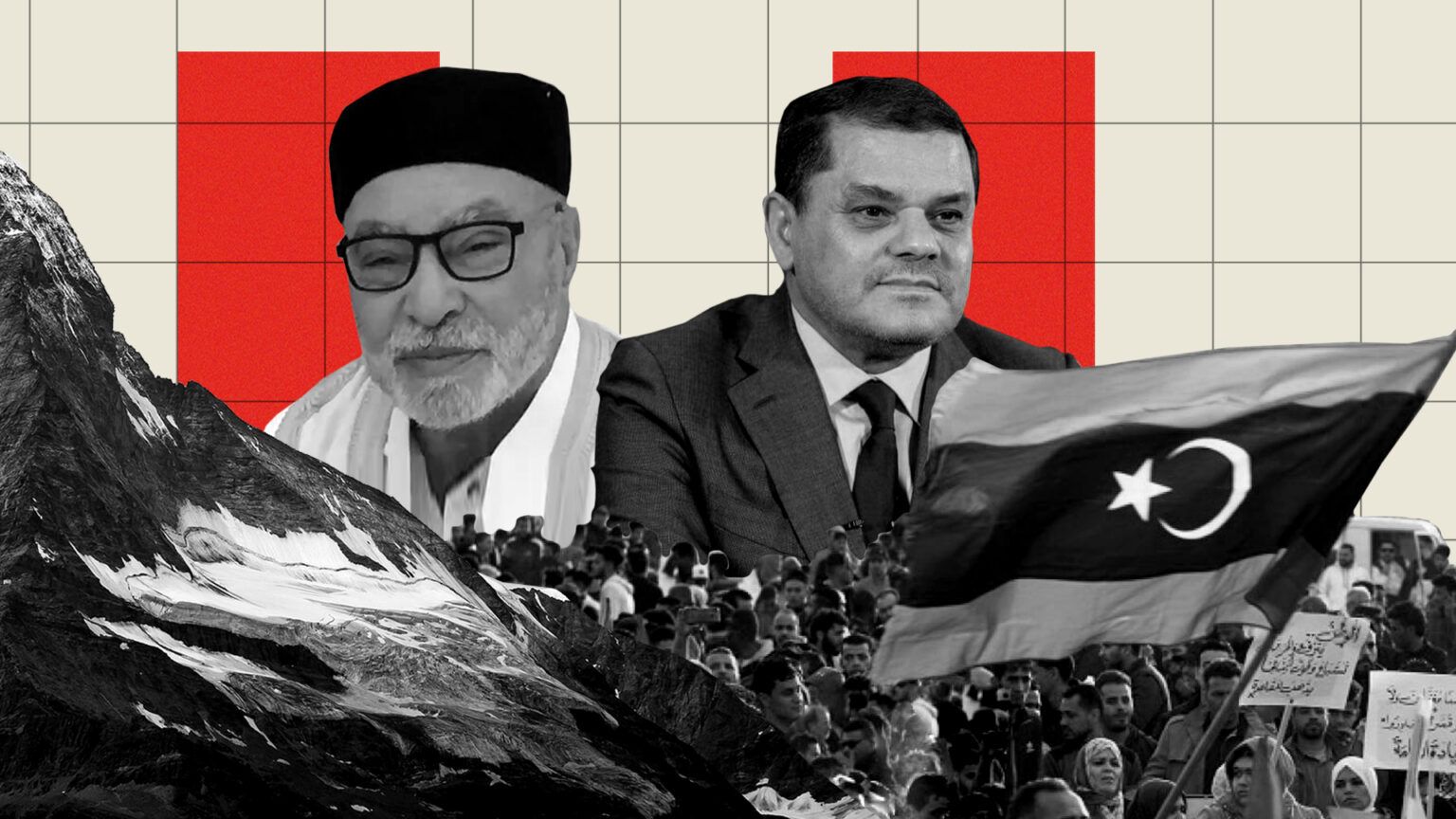

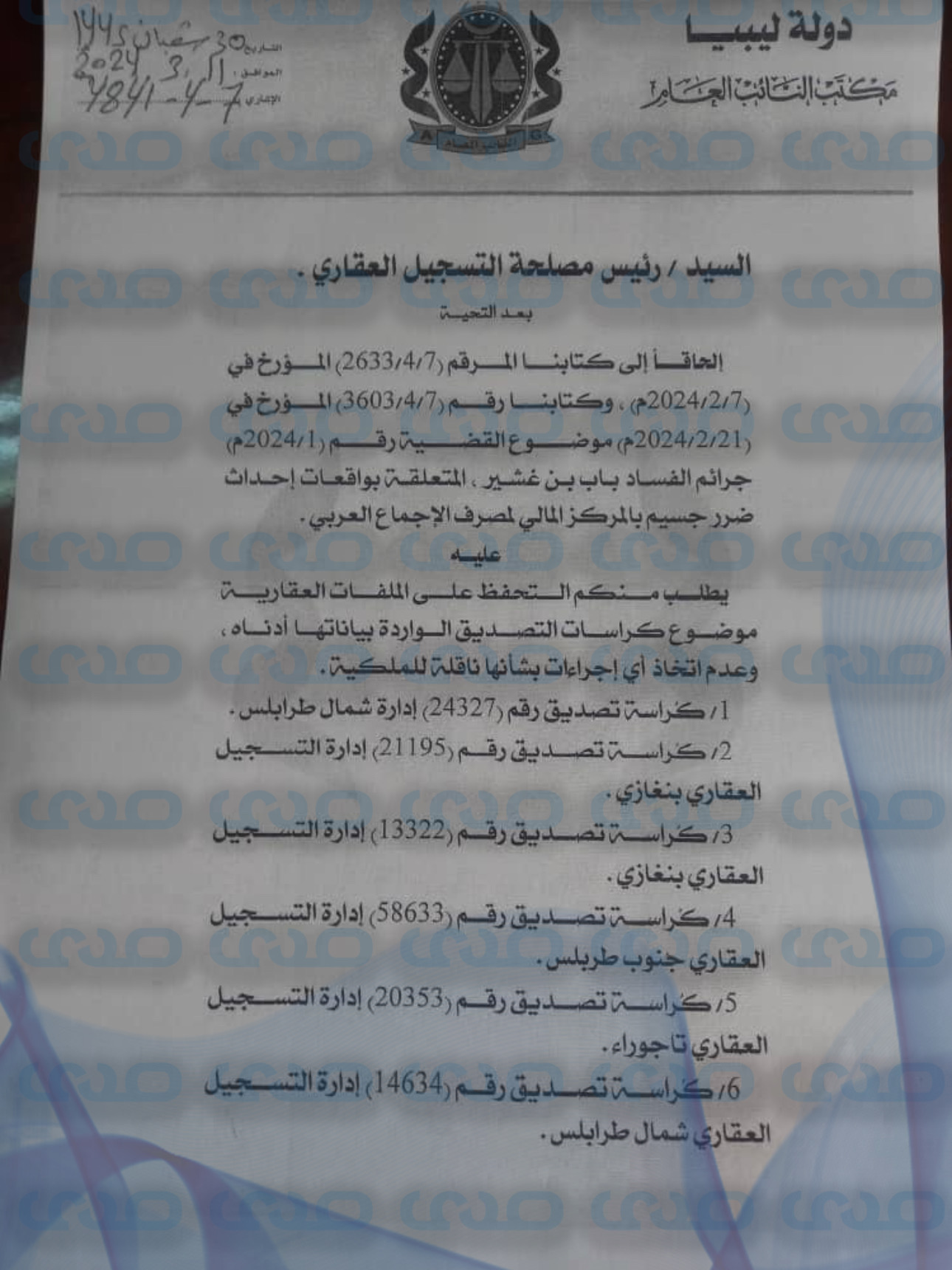

He continued by saying: Today, after half a century, we find that the true answer to this question is that the path of economic development in Libya was indeed interrupted in 1969, then resumed in 1973, then hindered in 1978, then failed from 1982 onwards. It is well established that the will for development was not available among the political leadership after 1969 and was not a priority. Despite the few attempts made by some sincere individuals, especially in the manufacturing sector, they were fragmented and incomplete attempts, not integrated with the rest of the economy, and did not create a significant impact on diversifying sources of income. The Libyan economy remains to this day primarily dependent on oil. Therefore, considering the reality we live in, especially in the last ten years, it may become sterile to discuss today and argue about a vision for diversifying sources of income and achieving economic development. Not because such ambition is unimportant, but because it has now become an unattainable dream after we have proven our failure to achieve it over 55 years (1969-2023), and we have entered into internal wars and caused economic problems. The current reality has changed, and its data and conditions no longer support the launch of development. These data include political and institutional division, wars, displacement, deliberate oil cuts, and the creation of black markets for foreign currency. The Central Bank could have prevented these crises if it had pursued a sound exchange rate policy and adhered to its commitment to the International Monetary Fund since 2003 not to allow multiple exchange rates. We now see that the central bank is violating this commitment for the second time. If the central bank were to achieve its objectives of monetary stability instead of creating monetary disruptions, as happened during the last six months, thinking about finding a vision for diversifying sources of income and achieving economic development would have been closer to reality if the Central Bank of Libya had adopted this vision as a state advisor in 2012, not now, before the current political crises and problems, which have eradicated the data of 2012. It could have been built on the data of 2012 all the aspirations and beautiful development visions.

He also said: Now, we must live with reality, understand its priorities, and move away from fantasy. Departing from the current reality requires us to set the following priorities:

1- Ending the state of war forever.

2- Achieving security.

3- Unifying political and administrative institutions, including the Central Bank and legislative and executive authorities.

4- Unifying the military institution and building the capacity to protect borders.

5- Establishing a culture of law respect, starting with the legislative pyramid.

Holding a referendum on the constitution, which has been obstructed since 2017 for nothing but personal interests. Before achieving these priorities, there is no room to realistically discuss diversifying domestic sources of income and achieving economic development. Naturally, this does not give anyone an excuse to deviate from proper economic behavior in managing their institution; neither the House of Representatives, nor the government, nor the central bank, nor others. All of them, regardless of the legitimacy issue, have a minimum duty to commit to the interest of the Libyan economy, which is the interest of the entire people, not the interest of a specific person.

In conclusion; Libya is indeed well off in terms of the availability of oil and non-oil resources, which qualify it to solve all its existing problems and then qualify it to engage in the battle for economic development competently. However, it is not well off in terms of those who tamper with these resources, causing wars, destabilizing security, insisting on institutional division, issuing and implementing laws, obstructing the referendum on the constitution ready for referendum for about seven years. Nor is it well off for the stubborn ones who insist on their narrow personal interests, whether ignorant or ignorant of the fact that the nation’s elevation means the elevation of all its individuals without exception.