Our source obtained exclusively the correspondence of the Central Bank of Libya to Yaqeen Bank, which included several observations.

It included cash deposits being deposited in some of the bank’s branches in the accounts of some companies, and they will be canceled on the same day during the year 2022) with a total amount of (205,256,137.84 Libyan dinars) and a number of (198) transactions, that justifiy forgery of documents. Those deposits were concentrated in the main branch (Tripoli – Zliten – Misrata) for a specific group of companies, not less than (50) companies.

Through the system of cash deposits and withdrawals, it was noted that there are some companies making deposits and withdrawals on the same day, and the amounts are large, which requires referring them to the Financial Information Unit to ensure the integrity of their procedures.

The bank’s violation of the circular letter No. (194/2019) regarding the interpretive instructions of the stamp tax law and paragraph (14) thereof that documentary credits covered with a full cash cover are not subject to the legally prescribed tax, except that the bank deducted the stamp tax on it, which the bank must return The total value of tax deducted to the accounts of the companies executing these appropriations.

The bank withdrew the tax value in cash on the executed documentary credits in the amount of (4,000,000.00 Libyan dinars) on 12/30/2021, with no evidence that the bank delivered the value to the tax authority in cash to date.

The bank deducted the value of the tax represented by a percentage of (0.002) for each documentary credit in Libyan dinars, and issued certified instruments and withdrawn amounts in cash with a total amount of (10,275,754.07 LYD), as it was later found that the bank had not delivered some of the certified instruments and cash amounts withdrawn to the Tax Authority to date.

The existence of discrepancies and differences between the daily report of the bank’s branch vaults and the report of the platform system according to the data of Al-Yaqin Bank.

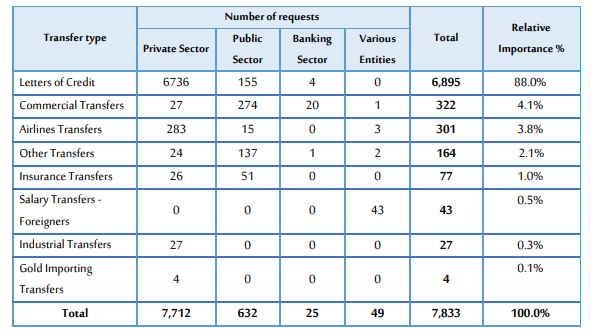

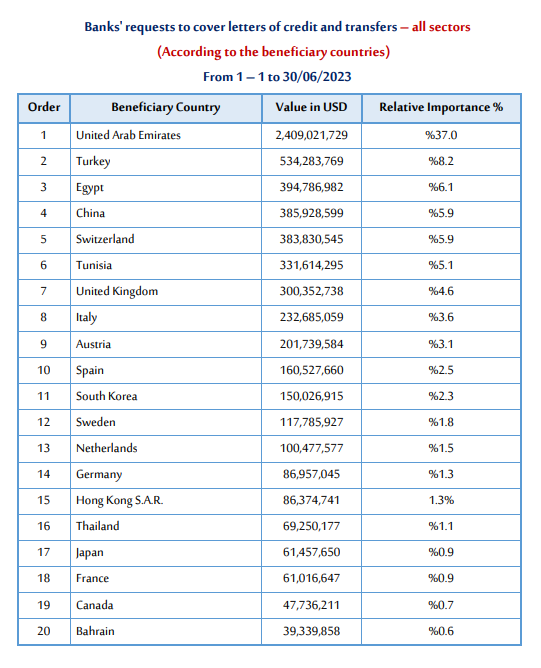

Many documentary credits were opened in favor of some companies, and the focus is on the UAE, although the goods are of Tunisian and Egyptian origin, which raises suspicions that those credits were implemented with a total amount of ($930,999,294.0) during the years 2022-2023, clear weakness and shortcomings in the performance of the bank’s internal audit department, weakness of the bank’s compliance department, and the suspension of the system specialized in combating money laundering (OFSAA) since 2022.

Opening documentary credits in large amounts for companies whose capital is not commensurate with the size of the credits opened to them, and non-compliance with the instructions of the Central Bank of Libya and the articles of association of the Certainty Bank by working to transfer the general administration of the bank to carry out its business to the main headquarters in the city of Sebha despite addressing the bank more than once in this regard.

In implementation of the provisions of Article (119) Paragraph (Second) of Law No. (1) of 2005 regarding banks amended by Law No. (46) of 2012, which stipulates without prejudice to the penalties stipulated in the law or in any other law and the procedures that can be taken under Provisions of Article (62) The Governor of the Central Bank of Libya may, when it is established that a bank or entity stipulated in Article (55) has violated any of the provisions of this law or the regulations or decisions issued pursuant thereto, to take any of the following measures, among which was (a warning).

Whereas, the Central Bank warned certainty of the need to correct all the above-mentioned notes within two months of its date, and to provide it with the measures taken in this regard.