| News

Exclusive: Al-Zantouti: “The Difference Between Check and Cash Is a Legitimate Cost, Not ‘Burning’; Caused by Liquidity Crisis, Corruption, and Security Conditions”

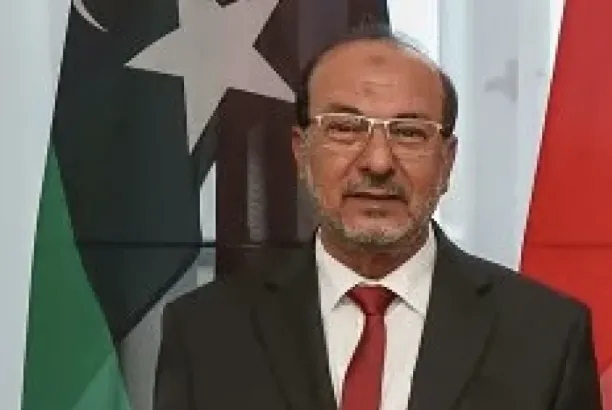

Economic analyst Khaled Al-Zantouti told our source in an exclusive statement:

“I don’t understand the origin of the term ‘burning a check’ — burning consumes the entire check, not just part of it!”

He continued:

“Away from the showy discussions of some so-called ‘analysts’ about economic theories, money supply, and monetary bases — with their often unrealistic numbers and analyses — I believe, from a practical point of view, that the difference between check and cash value represents a service fee. It’s compensation for the time value of money, covering the time gap between receiving the check and converting it into cash, as well as the effort spent in collecting it.”

He added:

“Therefore, the check-cash difference is a legitimate right for the party exerting effort to obtain its cash value, covering both the lost time and opportunity cost. It’s more accurate to call it a cost rather than burning.”

He explained:

“This additional cost, as everyone knows, results from the liquidity problem. So the cause is clear — but the question is: why has liquidity become a problem?”

He added that this problem is not recent or caused by the withdrawal of the 50-, 20-, and 5-dinar notes, but has existed for many years before those denominations were withdrawn.

He continued:

“In my humble opinion, there are two main, complementary reasons: the first is corruption, and the second is security.”

He elaborated:

“Corruption, by nature, is cowardly. The corrupt individual and his illicit funds must remain hidden and secret — even from close relatives — and are often literally kept under the tiles until they can be laundered.”

He continued:

“From there, the corrupt withdrew all their illicit money from banks. Through their agents inside the banks — perhaps for commissions — they withdrew most of the available cash and began laundering the money by injecting it into the market. They did this by buying dollars on the open market and speculating in foreign currencies at Souq Al-Mushir and near the Central Bank, or by purchasing real estate under the table and sometimes using fake names.”

He added:

“The second reason is security-related — fear that others might access information about their accounts and balances amid unhealthy security conditions.”

He continued:

“Therefore, unless we eradicate corruption and its roots, the liquidity problem will persist, ‘check burning’ will continue, and the dinar will keep losing value.”

He added:

“As for the 2% cash withdrawal fee, it is an attempt by the Central Bank to reduce large cash withdrawals, but it will harm ordinary citizens. The so-called ‘first-class’ individuals — those involved in shady deals — won’t care about the 2% as long as it serves their illicit trade and money laundering.”

He also said:

“I should note positively the Central Bank’s efforts to promote and expand the use of electronic payment systems. In fact, I urge the Central Bank to accelerate the adoption of digital banking and learn from other countries’ experiences — though I remain convinced that ‘the thief often outsmarts the guard.’ Still, I thank the Central Bank for taking this step, even if it came late.”

He concluded:

“Finally, in most countries, laws permit any current account holder — if the bank refuses to allow them to use their balance in any legitimate way — to file a court request at any time to declare the bank bankrupt.”