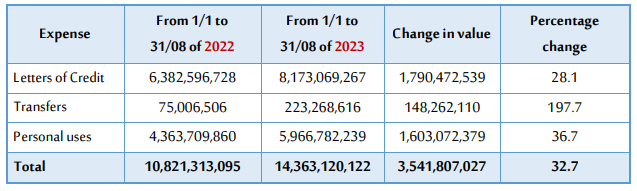

The total uses of foreign exchange by banks from 1/1 – to 31/08/2023 amounted to about

$14,363,120,122 compared to $10,821,313,095 during the same months of 2022, with an

increase of about $3,541,807,027 at arate of 32.7%.

The letters of credit accounted for 56.9% of total bank uses of foreign exchange, personal

purposes accounted for 41.5% of total bank uses of foreign exchange, while transfers accounted

for only 1.6% of total uses.

Amounts sold to banks in foreign exchange for all purposes:

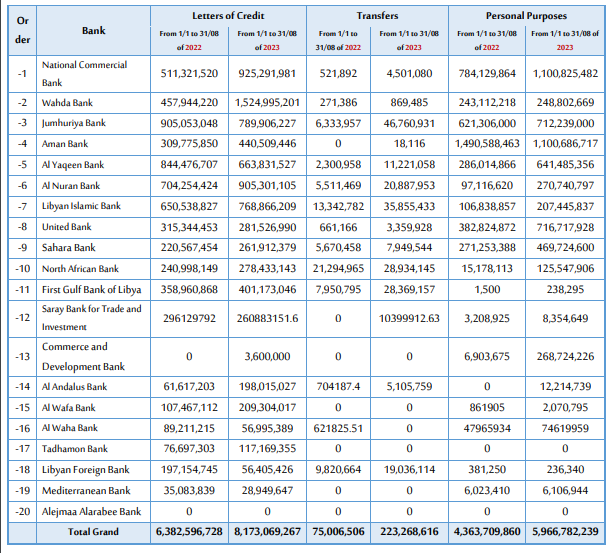

Within the framework of the Banking and Monetary Supervision Department’s follow-up to the

accepted purchase requests for letter of credits and remittances, submitted by commercial banks

through the system for following-up requests for coverage, and foreign exchange sales for

personal purposes, in accordance with the decision of the Board of Directors of the Central Bank

of Libya No. (1) of 2020 regarding amending the exchange rate of the Libyan dinar and Banking

and Monetary Supervision Department Circular No (9/2020).

According to the table below, which illustrates the values sold of foreign exchange by banks, it is

clear that National Commercial Bankwas the most bank purchased foreign exchange from1/1 –

to 31/08/2023 with a market share of 14.1%, as the total amounts of foreign exchange

purchased was about $2,030,618,543 followed by Al-Wahda Bank with a value of

$1,774,667,355, then Jumhouria Bank was in the third place with a value of $1,548,906,158.

Then Aman Bank for Trade and Investment was ranked fourth with a value of $1,541,214,279,

then the following banks come in terms of relative importance in order: Al-Yaqeen Bank, AlNouran Bank, the Libyan Islamic Bank, the United Bank, and the Sahara Bank. of the banks as

shown in the table below, which also contains the order in which they were Banks during the

same period last year 2022.

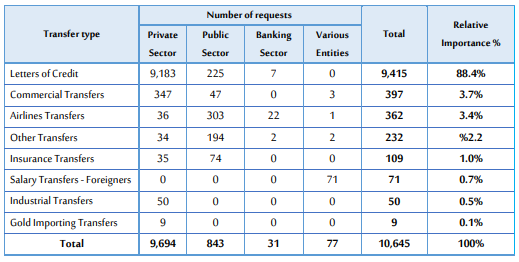

Second: Accepted bank requests to cover Letters of Credit and transfers, except for personal purposes, from 1/1 – to 31/08/2023:

The number of companies, factories, public entities,and other entities whose applications were

approved to purchase foreign exchange from 1/1 – to 31/08/2023 has reached (1,744), with a

number of total requests amounting to 10,645 applications. Most of these applications were

made in purpose to cover letters of credit, which were 9,415 applications, 88.4% of the total

applications, as shown in the following table:

Firstly: Requests to all Sectors: Banks’ requests to cover letters of credit and transfers – all sectors

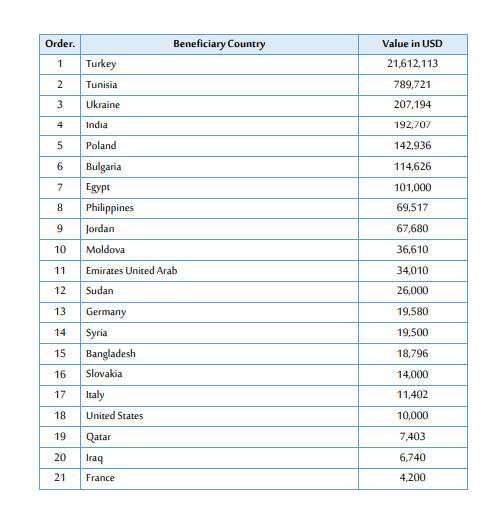

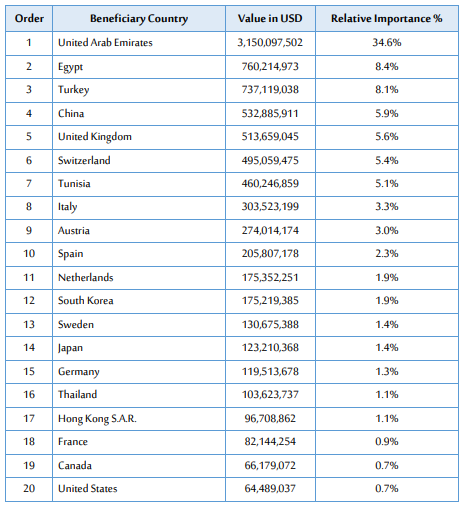

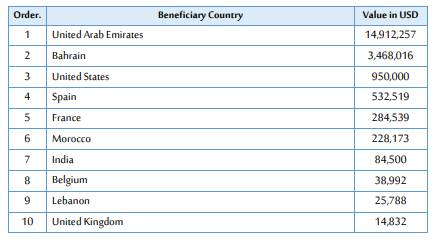

1- According to the beneficiary countries

The table below shows the values of banks’ requests made by all sectors to purchase foreign

exchange from1/1 – to 31/08/2023, the table iullstates the value in terms of beneficiary

countries, the data showsthat 34.6% of bank transfers to cover letters of credit or other transfers

were to the United Arab Emirates, whereas Egypt was in second place with a rate of 8.4%,

followed by Turkey, Chinaand United Kingdomwith rates of 8.1%, 5.9%,and 5.6%, respectively.

The following table shows the important twenty beneficiary countries.

According to the top twenty beneficiary countries

From 1 – 1 to 31/08/2023

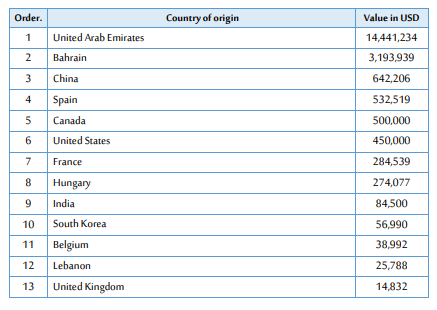

2- According to the countries of origin for the goods or services

The table below shows the values of banks’ requests madee by all sectros to purchase foreign

exchange by goods or services origins from 1/1 – to 31/08/2023, it is clear that Turkeyranked

first, as goods or services of Turkish origin accounted for 20.1% of the total accepted purchase

requests. Imports of goods or services of Egyption origin came in second place, accounting for

13.2% of the total, and goods or services of Chinese origin accounted for 13.0% ranked third

during the period, while goods and services of Russian origin accounted for 7.4%, and those of

Indian origin accounted for 5.5%, while the goods and services of Tunisian origin accounted for

4.1% of the total. The following table shows twenty countries of origin for goods or services.

According to the countries of origin for the goods or services

From 1 – 1 to 31/08/2023

Secondly: Requests According to Sectors:

From 1/1 – to 31/08/2023

1- Private sector:

Duing the period from 1/1 – to 31/08/2023, the number of private sector companies and

factories were (1,624) whose requests foreign exchange to cover letters of credit and other

transfers were approved. Banks’ requests to purchase foreign exchange by the private sector to

import production and operation requirements ranked first among total purchase requests

during the period, accounting for 17.0% of total foreign exchange purchase requests. While the

requests to cover import of commodity production requirements ranked second with relative

importance of 11.1%, whereas the requests to cover the accounted for miscellaneous food

commodities accpunted for 10.8%, and the import of feed acoounted for 8.8% of the total.The

following table shows the purchase requests for commodities or services during the reported

period.

From1/1 – to 31/08/2023

From 1/1 – to 31/08/2023

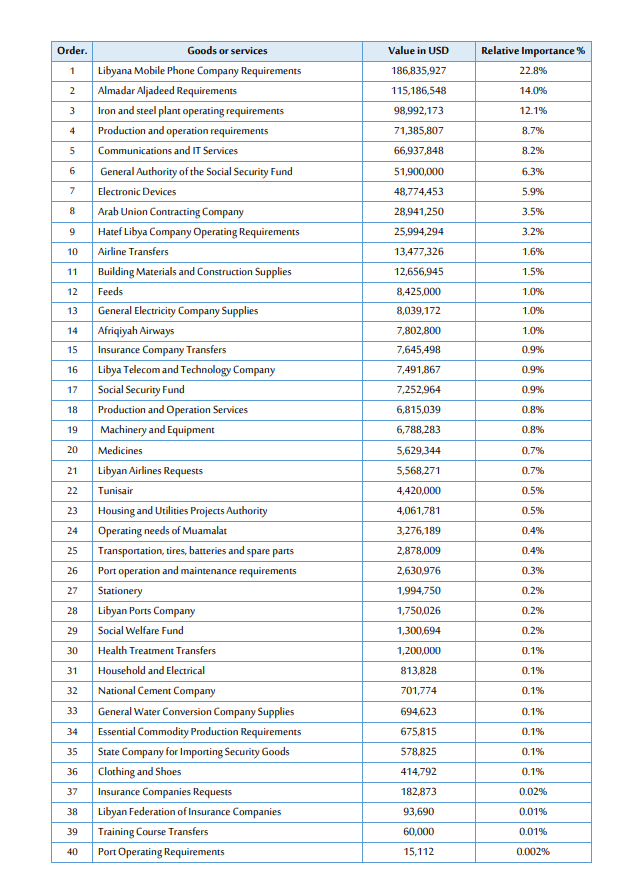

2- Public Sector

The number of public sector entities whose requests for foreign exchange to cover letters of

credits and other transfers were approved reached 42 entitiesfrom1/1 –to 31/08/2023.Where

banks’ requests to purchase foreign exchange Libyana Mobile Phone Company, ranked first from

the total purchase requests during the reported period, accounting for 22.8% of the total foreign

exchange purchase requests, while by Almadar Aljadeed ranked the second with relative

importance of 14.0%, whereas requests from Libyan Iron and Steel Company accounted for

12.1%, while the requests to cover Production and Operation Requirements accounted for 8.7%,

and the requests to cover the import of Communications and IT Services at a rate of 8.2%. The

following table shows purchase requests made by the public sector.

From1/1 – to 31/08/2023

From1/1 – to 31/08/2023

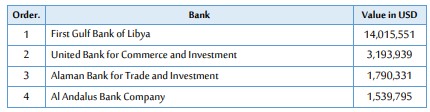

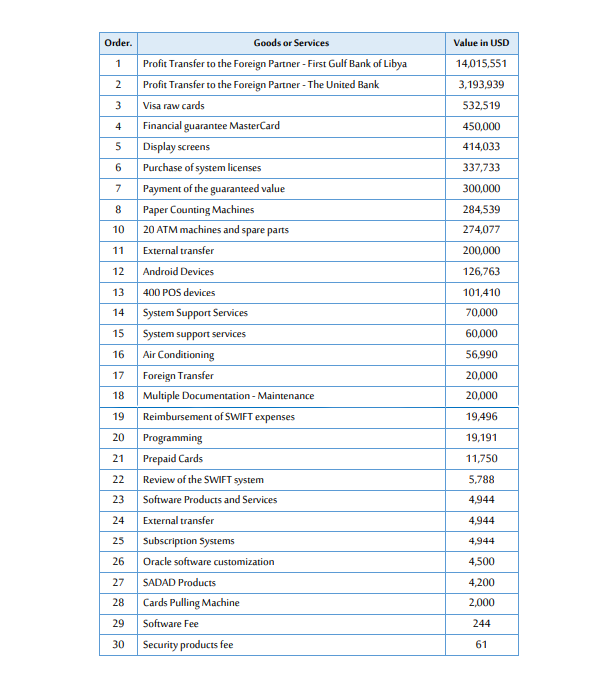

3- Banking Sector :

From 1/1 – to 31/08/2023

“Descending order”

“Descending order”

From 1/1 – to 31/08/2023

“Descending order”

“Descending order”

4- Foreigners (salary transfers) :

Foreign Transfers -Salaries

From 1/1 – to 31/08/2023