| News

Exclusive: Central Bank Demands Accurate Sorting of Withdrawn Banknotes and Circulates Withdrawal Implementation Mechanism

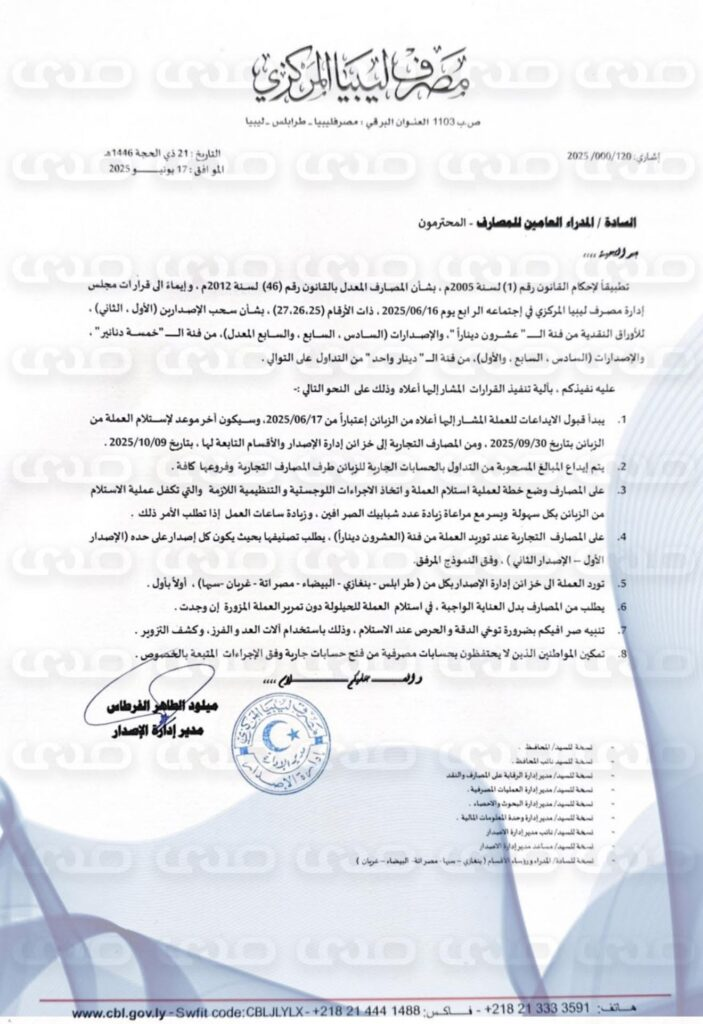

Our source has exclusively obtained a circular from the Director of the Issuance Department at the Central Bank, addressed to commercial banks, outlining the mechanism for implementing the decision to withdraw certain currency denominations from circulation (1 dinar, 5 dinars, and 20 dinars).

Key points of the circular:

- Deposits of the mentioned banknotes by customers will be accepted starting from June 17, 2025, with the final deadline for accepting deposits from customers set for September 30. The final deadline for banks to transfer these banknotes to the vaults of the Issuance Department and its branches is October 9, 2025.

- The amounts withdrawn from circulation are to be deposited into the customers’ current accounts at all commercial banks and their branches.

- Banks are required to develop a plan for receiving the withdrawn currency and to take the necessary logistical and organizational measures to ensure a smooth and easy deposit process for customers, including increasing the number of teller windows and extending working hours if necessary.

- When commercial banks deliver the 20-dinar notes, they must sort and categorize them by issuance (first issue – second issue), according to the attached template.

- Withdrawn currency must be delivered to the vaults of the Issuance Department in Tripoli, Benghazi, Al-Bayda, Misrata, Garabulli, and Sebha on a rolling basis.

- Banks are required to exercise due diligence when receiving currency to prevent the acceptance of counterfeit notes, if any exist.

- Tellers must be alerted to exercise extreme caution and precision when receiving deposits, using currency counting and sorting machines, as well as counterfeit detection devices.

- Citizens who do not currently hold bank accounts must be allowed to open current accounts in accordance with the applicable procedures.