| News

Exclusive: Central Bank Governor Requests Shakshak’s Approval to Initiate Contracting with a Specialized Company for Continued Engagement with the Federal Reserve Bank

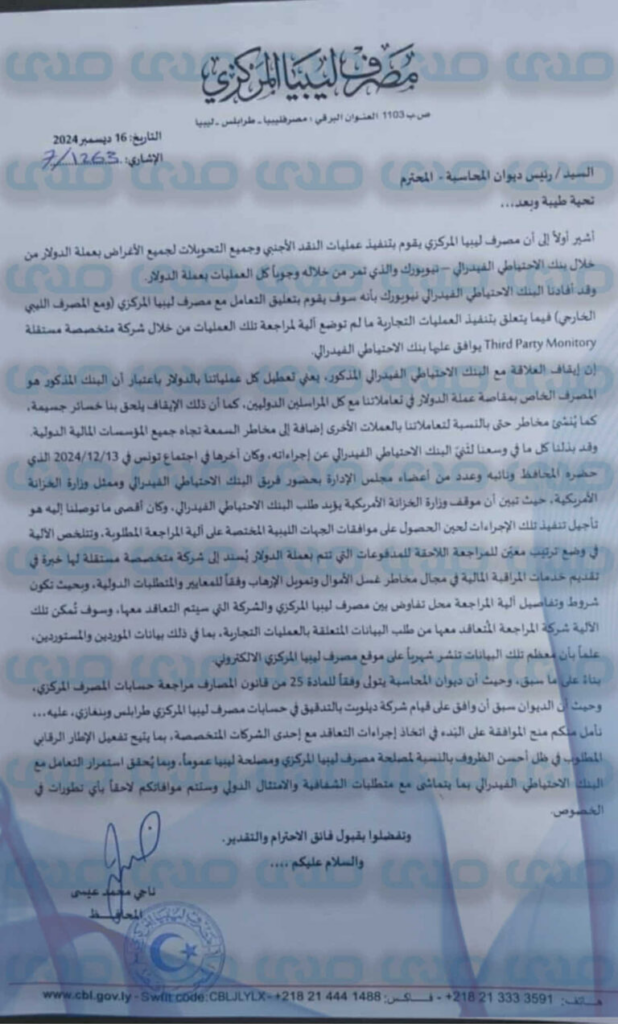

Our source has exclusively obtained a correspondence from the Governor of the Central Bank of Libya to the President of the Audit Bureau. In this letter, the Governor indicated that the Central Bank of Libya executes foreign exchange transactions and all transfers in US dollars through the Federal Reserve Bank in New York, which is the mandatory intermediary for all dollar-denominated transactions.

The Governor stated that the Federal Reserve Bank of New York has informed the Central Bank of Libya that it will suspend its dealings with the Central Bank of Libya (and the Libyan Foreign Bank) concerning the execution of commercial operations unless a mechanism for reviewing such transactions through an independent specialized company, referred to as a Third-Party Monitor, is established and approved by the Federal Reserve Bank.

He further explained that severing ties with the Federal Reserve would mean the suspension of all dollar transactions, as the Federal Reserve is the clearinghouse for dollar transactions with all international correspondents. Such suspension would lead to significant financial losses and expose the Bank to risks regarding transactions in other currencies, as well as reputational damage with international financial institutions.

The Governor emphasized that every effort had been made to dissuade the Federal Reserve from taking this action, most recently during a meeting in Tunis on December 13, 2024. The meeting was attended by the Governor, his deputy, and several board members, along with the Federal Reserve team and a representative from the U.S. Treasury Department. During the meeting, it was made clear that the U.S. Treasury supported the Federal Reserve’s demand. The best outcome achieved was a delay in implementing the suspension until the Libyan authorities approved the required review mechanism.

The proposed mechanism involves establishing a specific arrangement for post-payment reviews of dollar transactions. This would be entrusted to an independent specialized company with expertise in providing financial monitoring services, particularly in the areas of anti-money laundering and counter-terrorism financing, in accordance with international standards. The terms and details of this review mechanism would be subject to negotiations between the Central Bank of Libya and the selected company. This mechanism would grant the contracted auditing firm access to data related to commercial transactions, including supplier and importer information. It is worth noting that most of this data is already published monthly on the Central Bank’s website.

In conclusion, the Governor stated that, based on the above and in light of Article 25 of the Banking Law, which entrusts the Audit Bureau with auditing the Central Bank’s accounts, and considering that the Bureau had previously approved Deloitte’s auditing of the Central Bank’s accounts in Tripoli and Benghazi, he requested approval to proceed with contracting one of the specialized companies. This would enable the implementation of the required regulatory framework under optimal conditions for the benefit of the Central Bank and Libya as a whole. It would also ensure continued engagement with the Federal Reserve in line with transparency and international compliance requirements. The Governor pledged to update the Audit Bureau on any further developments in this matter.