| Corruption Files

Exclusive: Documents and Commercial Records Reveal Libyan Islamic Bank’s Financing to Al-Dawadi Companies – Central Bank Issues Warning, Bank Provides Justification

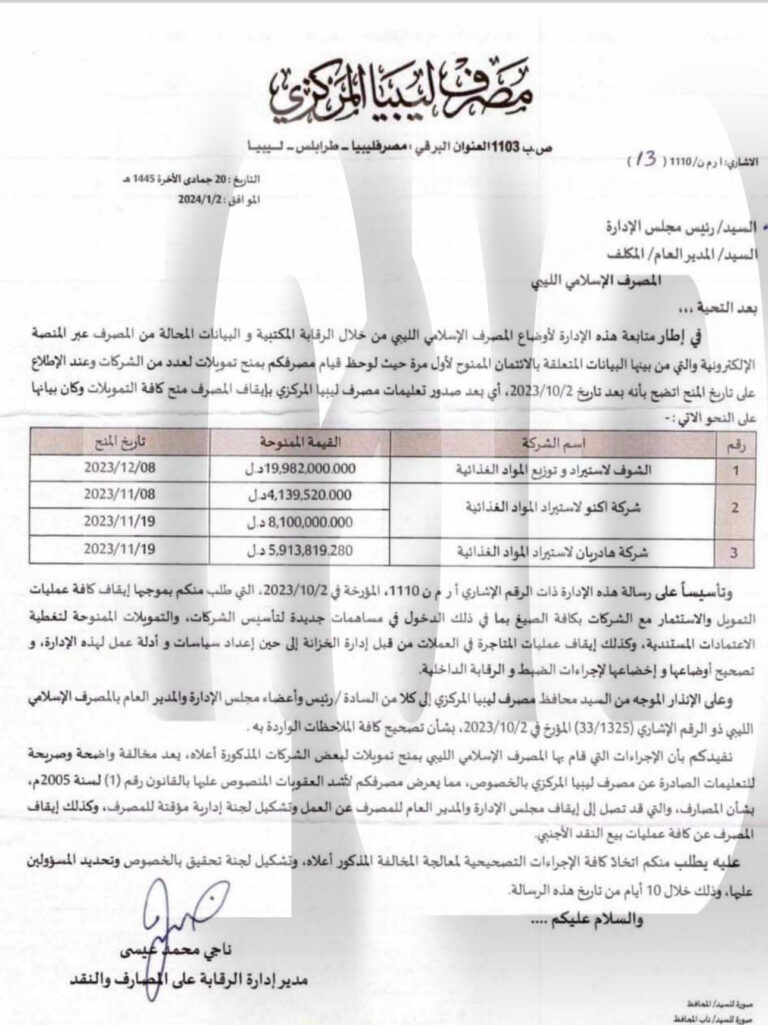

Our source obtained a correspondence from the Central Bank of Libya to the Libyan Islamic Bank, which included granting financing to several companies worth millions, in violation of its instructions. This action could subject the bank to severe penalties, including the suspension of the board of directors and the general manager, the formation of a temporary administrative committee, and the cessation of the bank’s foreign currency sales operations. The Central Bank demands corrective measures and the formation of an investigation committee to identify those responsible within 10 days.

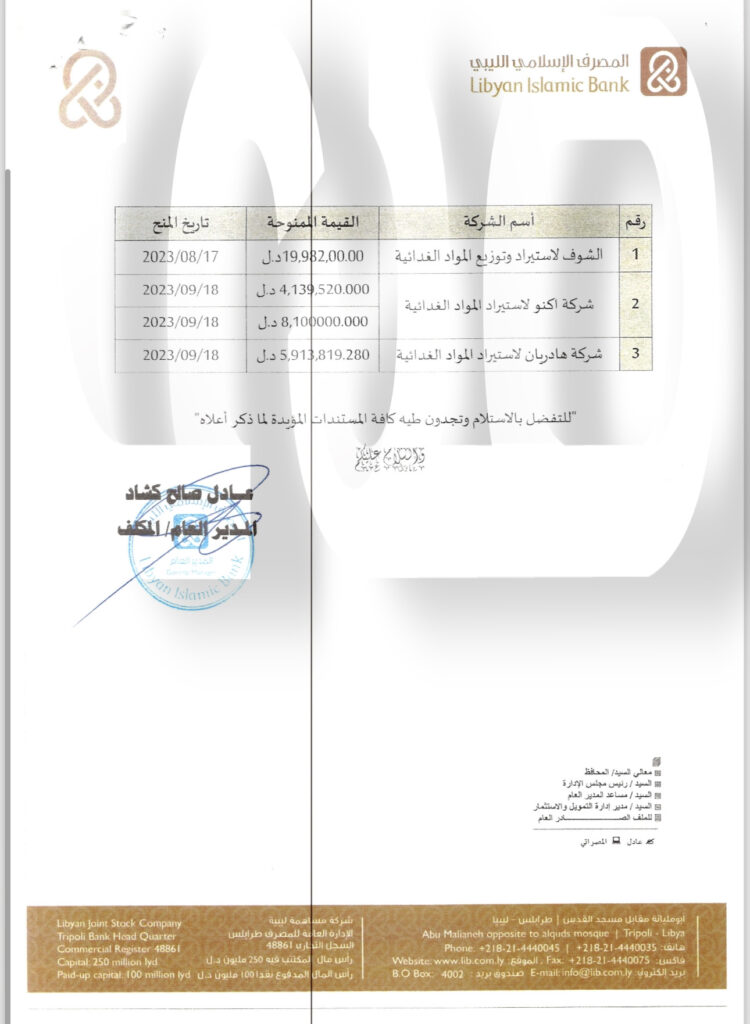

In response, the general manager of the Islamic bank stated in a correspondence to the bank’s supervisory management at the Central Bank that the bank’s management is committed to complying with the instructions of the Central Bank of Libya and has not granted any financing after the suspension date.

The error in the platform is attributed to insufficient data fields and failure to keep up with financial engineering operations. These financings represent salam transactions conducted with dates preceding the suspension, and the commitment to receiving purchased goods was on dates later than the salam contracts. Therefore, the employee responsible filled in the delivery dates in the grant date field and clarified this, attaching an extract from the banking system showing the dates of salam financing grants.

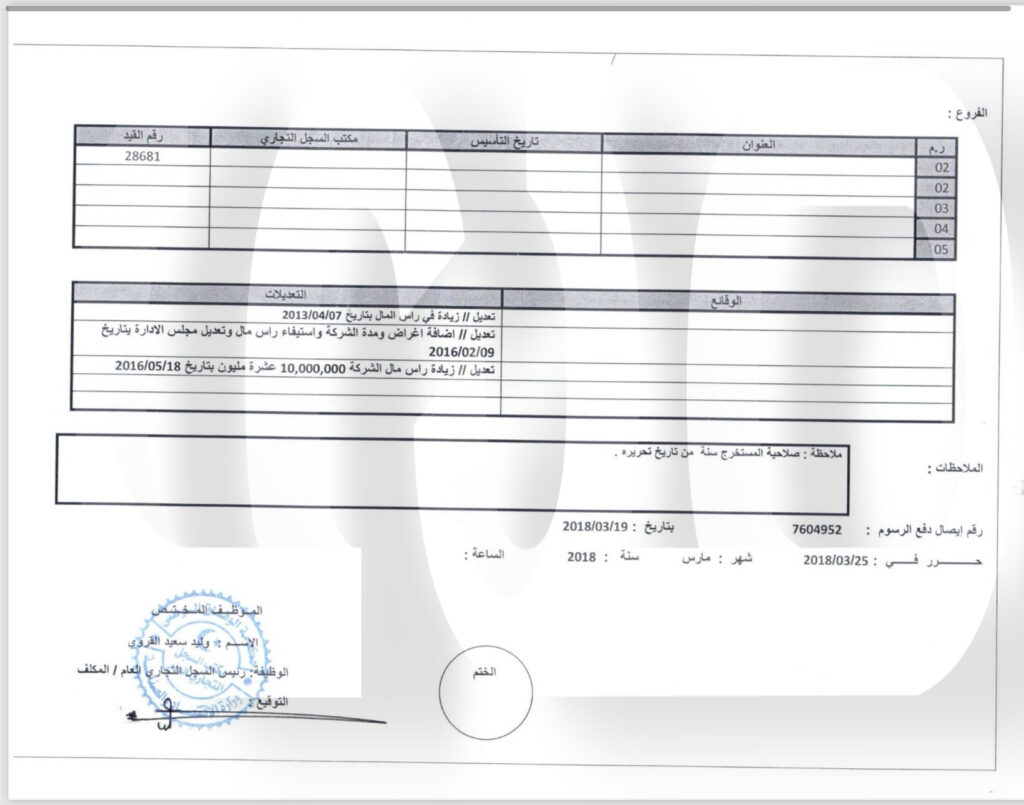

It is worth mentioning that the financings highlighted in the Central Bank’s correspondence include a grant of $19.9 million to the Shouf Company for importing and distributing foodstuffs, owned by “Faisal Mawlood Abu Al-Qasim Al-Dawadi” according to the commercial register exclusively obtained by Economic Echo newspaper, a member of the prominent shareholders’ family “Abdul Basit Al-Dawadi”.

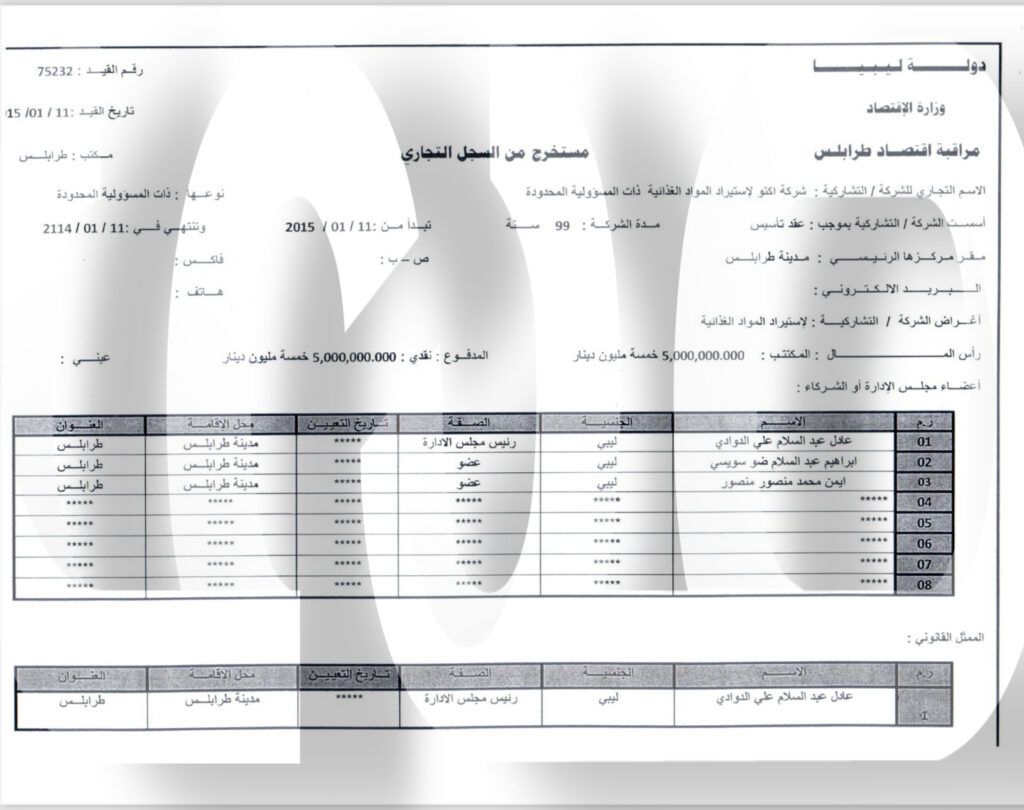

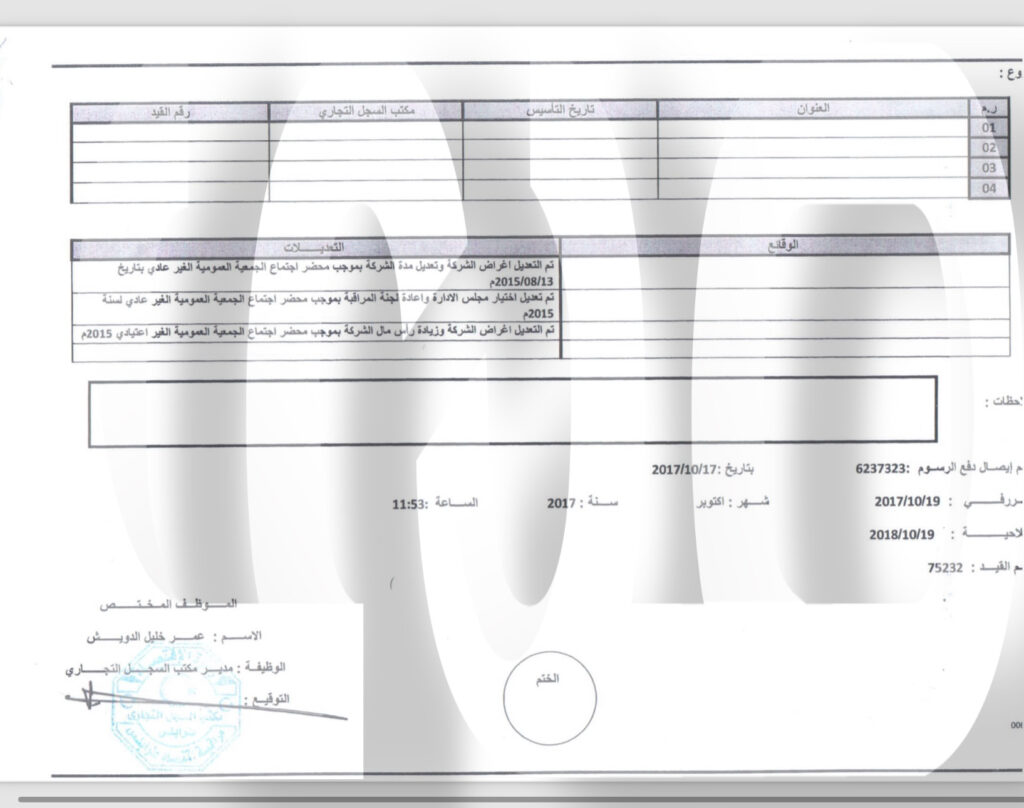

Our source also obtained the commercial register of Aktou Food Imports, which the Central Bank mentioned had been granted financing by the Islamic Bank: one totaling $4.139 million and another worth $8.100 million. Its owner, Adel Abdul Salam Ali Al-Dawadi, is from the prominent shareholder family, Abdul Basit Al-Dawadi.

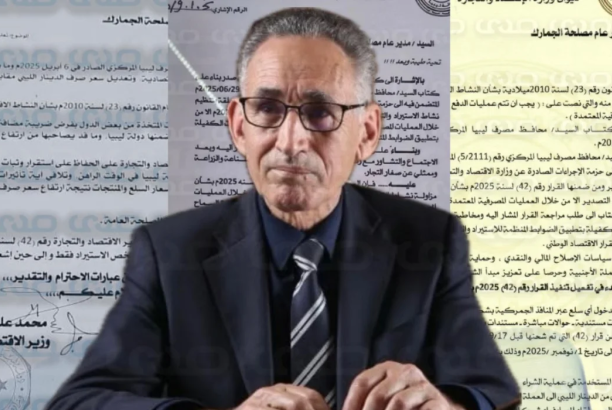

It’s worth noting that the Central Bank of Libya made decisions last year to suspend granting financing to the Islamic Bank due to several observations recorded regarding the major shareholder, Abdul Basit Al-Dawadi, granting financing to his own companies in violation of regulations, prompting the bank to issue a new warning.