| News

Exclusive: Zantouti to Sada: 7% Commission Tempts Currency Dealers, Exchange Companies Could Become a “Legit Mushir Market”… and I Doubt the Central Bank’s Ability to Control It

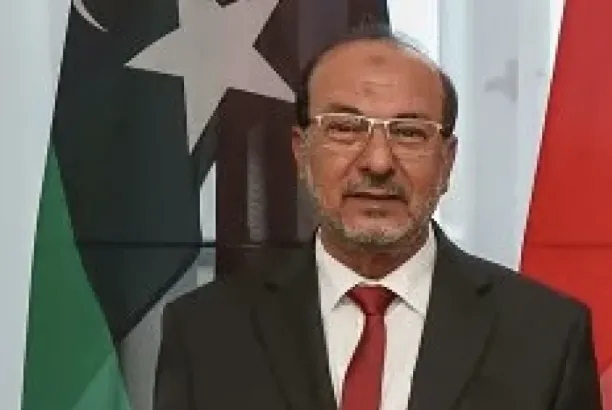

Financial analyst Khaled Al-Zantouti told our source in an exclusive statement:

“I am undoubtedly in favor of these regulatory measures — but what matters is their implementation.”

He added:

“Exchange companies are theoretically channels for buying and selling foreign currency and carrying out local and international money transfer services. They also play a positive role in supporting tourism, trade, and all economic activities related to international commerce. So, there’s no disagreement on the concept or role of exchange companies. Most countries adopt such channels under the supervision of central banks due to their activities being tied to key variables such as exchange rates and money supply.”

He continued:

“The Central Bank of Libya has issued many relevant legislations, including the 2010 law and subsequent regulations — the most recent of which was just released.

The real issue will be in implementation and the exploitation of these channels for illicit transfers and to cover certain aspects of corruption.

I believe those currently controlling the parallel market will try to dominate a large portion of the activities of licensed exchange companies. Some may even offer millions to purchase these companies, and I fear they will resume their previous activities from Al-Mushir market but under the legal cover of exchange companies.”

He also stated:

“A 7% commission for exchange companies is a high figure that will certainly tempt currency dealers, and they will use all means to achieve it. It wouldn’t be surprising to see a new parallel market emerge within these exchange companies — an OTC (Over The Counter) scenario.

In my personal opinion, if this rate (or a lower one) was set as a cap, exchange companies could then compete under that limit.”

He added:

“I also hope exchange companies will be allowed to trade in international currency markets, in accordance with international standards — with the freedom to buy dollars, not just sell them, and with a narrow margin between buy and sell prices.”

He emphasized:

“As for the new system for opening letters of credit, I am uncertain about its technical capability to monitor credit from initiation until the goods arrive at Libyan ports.

Our problem with letters of credit has been clear for years — goods often don’t arrive according to the specifications and terms stated.

Even Al-Mushir market’s dollar supply is partly based on stolen letter-of-credit funds, with large portions being converted to liquid dollars via shell companies and third parties in the UAE or Turkey.

It’s a complex scheme — credit holders exploit it by converting parts into cash, which is then brought into Al-Mushir market and sold on the parallel currency market. Can these procedures and this new system correct the flaw? We hope so.”

He concluded:

“As for the impact on the dinar’s exchange rate and any possible devaluation, that will depend on the Central Bank’s ability to defend the fair value of the dinar under all circumstances, and how well it can regulate exchange companies and letters of credit according to current legislation and international standards. Frankly, I doubt it — may God help them.”