Shnibish Writes: “Seasonal Greed and Electronic Services Security: Between Transaction Growth and Protection Assurance”

Written by Anas Shnibish: “Seasonal Greed and Electronic Services Security: Between Transaction Growth and Protection Assurance”

With the increasing reliance on electronic services in various aspects of life, digital security has become a top priority. At the same time, the concept of “seasonal greed” emerges, referring to peak periods in the use of these services, such as seasonal promotions, holidays, major discounts, and annual events. During these times, user activity surges, posing significant cybersecurity challenges.

The question here is: What role do banks, service providers, and customers play in enhancing the security of electronic services, especially during peak seasons?

The Role of Banks in Electronic Security

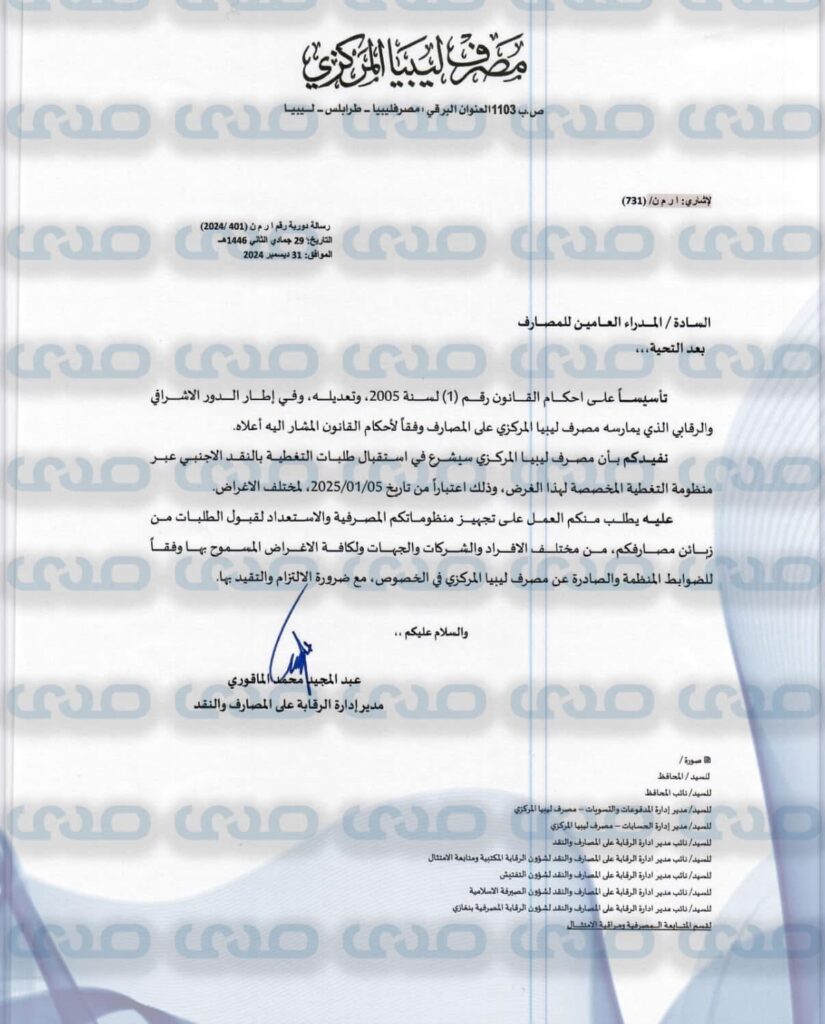

Banks are responsible for securing digital financial transactions, protecting customer data, and preventing fraud. Their role includes:

- Enhancing security systems: Utilizing strong encryption, firewalls, and fraud detection systems to monitor suspicious activities.

- Providing two-factor authentication (2FA): Requiring an additional verification code when logging in or making payments.

- Monitoring transactions and detecting fraud: Using artificial intelligence to analyze financial operations and identify any unusual activities.

- Launching awareness campaigns: Sending alerts and warning messages about cyber fraud methods such as phishing and fake websites.

- Offering secure payment tools: Including virtual cards and tokenization technology to prevent the theft of original card data.

The Role of Electronic Service Providers

Electronic service providers include e-commerce platforms, payment processors, internet service providers, and fintech companies. Their responsibilities include:

- Implementing strong security protocols: Such as HTTPS protocol, advanced encryption (SSL/TLS), and intrusion detection/prevention systems (IDS/IPS) to protect user data.

- Ensuring system stability during peak periods: By optimizing server performance and utilizing cloud computing technologies to prevent downtime and security breaches.

- Conducting regular security audits: To detect and fix vulnerabilities in websites and applications.

- Protecting customer data: Through policies such as not storing sensitive payment information and encrypting user details.

- Developing additional verification tools: Such as biometric authentication (fingerprint or facial recognition) to secure electronic transactions.

The Customer’s Role in Protecting Their Data and Funds

Despite the significant efforts of banks and service providers, the customer remains the weakest link if they do not follow essential security measures. Their responsibilities include:

- Not sharing sensitive information: Such as passwords, bank card details, or verification codes with any unauthorized entity.

- Purchasing only from trusted websites: Ensuring they use HTTPS protocol and have clear data protection policies before entering payment details.

- Enabling two-factor authentication (2FA) on financial and electronic accounts.

- Regularly updating passwords: Using strong, unique passwords for different accounts.

- Reviewing banking transactions regularly: And immediately reporting any unknown transactions.

- Avoiding clicking on suspicious links: Sent via email or text messages, as they may be phishing attempts.

Conclusion

Ensuring the security of electronic services requires joint cooperation between banks, service providers, and customers. While banks work on securing financial transactions, service providers must offer a safe electronic infrastructure, and customers must follow basic protection measures to avoid falling victim to cyber fraud. In the end, cybersecurity is a shared responsibility, and any weakness in one party can lead to risks that threaten everyone.