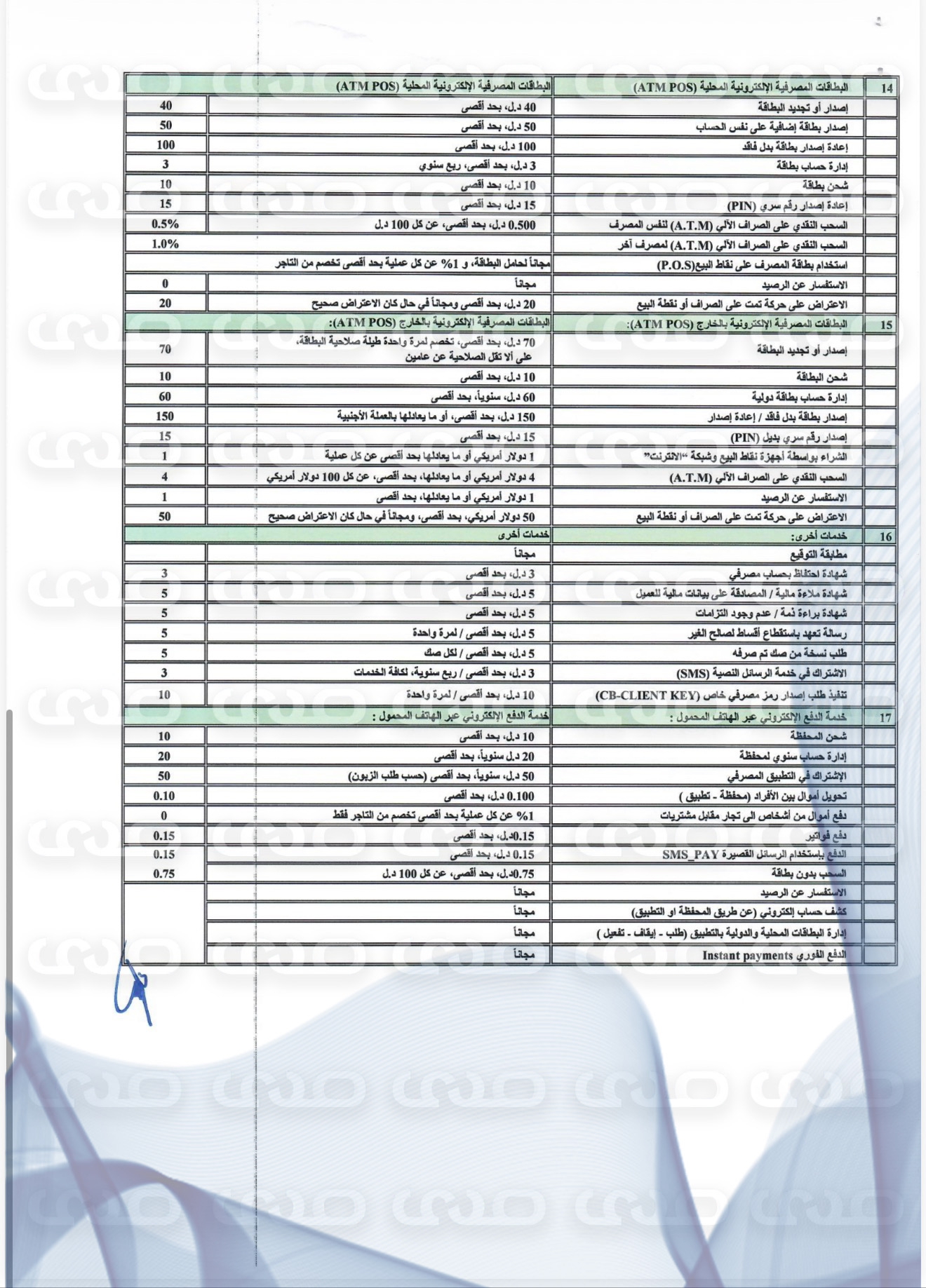

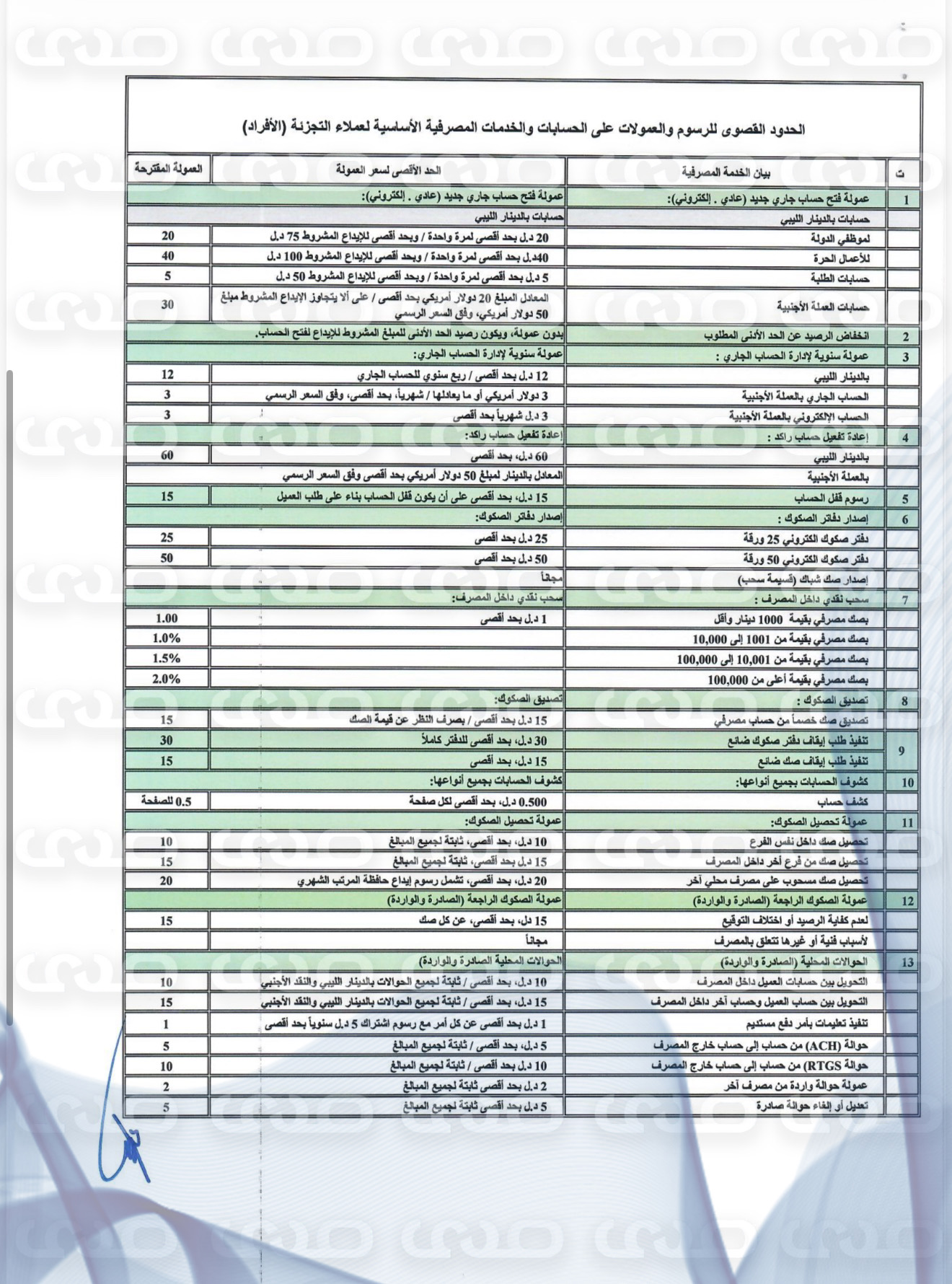

Our source has exclusively obtained the Central Bank’s circular to banks regarding the pricing regulations for electronic services. The circular outlines the maximum fees and commissions for accounts and basic banking services for retail clients (individuals). These include opening a new current account (regular or electronic) with a maximum one-time fee of 20 dinars, and a maximum conditional deposit of 75 dinars, with an equivalent maximum of 20 USD, provided the conditional deposit does not exceed 50 USD.

According to the circular and the table provided, the annual commission for managing a current account in dinars is 12 dinars, with a maximum of a quarter of the account level; for foreign currency accounts, the fee is 3 USD or its equivalent monthly at the official rate. For electronic foreign currency accounts, the fee is 3 dinars per month. Re-activating a pioneer account in dinars carries a maximum fee of 60 dinars, and in foreign currency, the equivalent of 50 USD according to the official rate. Account closure fees are 15 dinars maximum, provided the closure is requested by the client.

Issuing an electronic checkbook of 25 sheets carries a fee of 25 dinars, 50 sheets a fee of 50 dinars, and issuing a teller check is free. Cash withdrawal inside the bank via a bank check up to 1,000 dinars carries a fee of 1 dinar. Certifying a check deducted from a bank account costs 15 dinars, regardless of the check value. Collecting checks within the same branch costs 10 dinars, from another branch 15 dinars, and from another local bank 20 dinars maximum. Returned checks (issued or incoming) due to insufficient funds or signature mismatch are charged 15 dinars.

For local transfers, outgoing or incoming, transfers between the client’s accounts within the bank cost 10 dinars, transfers between the client and another account in the same bank cost 15 dinars. Standing order instructions cost 1 dinar maximum, with an annual subscription fee of 5 dinars. An ACH transfer from one account to another outside the bank costs 5 dinars, an RTGS transfer costs 10 dinars, incoming transfers from another bank 2 dinars, and modification or cancellation of a transfer 5 dinars.

Regarding local electronic banking cards (ATM/POS), issuing or renewing a card costs 40 dinars, issuing an additional card for the same account costs 50 dinars, and re-issuing a lost card costs 100 dinars. Card account management costs 3 dinars, topping up the card costs 10 dinars, and re-issuing a PIN costs 15 dinars. Cash withdrawal at the same bank’s ATM is 0.5 dinars per 100 dinars maximum, while balance inquiry is free. Disputing a transaction at an ATM or POS costs 20 dinars.

For international electronic cards (ATM/POS), issuing or renewing the card costs 70 dinars maximum, charged once for the card’s validity, which must not be less than two years. Topping up the card abroad costs 10 dinars, international card account management 60 dinars, re-issuing a lost card 150 dinars, replacing a PIN 15 dinars, purchases via POS or online 1 USD, ATM cash withdrawal 4 USD, balance inquiry 1 USD, and disputing a transaction 50 USD.

Other services include free signature verification, account retention certificate 3 dinars, financial solvency certificate or verification of financial data 5 dinars, clearance certificate / proof of no liabilities 5 dinars, commitment letter for installment deductions 5 dinars, requesting a copy of a cashed check 5 dinars, SMS subscription 3 dinars, and issuing a private banking code 10 dinars.

For mobile electronic payment services, card top-up costs 10 dinars, annual wallet account management 20 dinars, banking app subscription 50 dinars, P2P transfers (terminal-app) 0.1 dinar maximum, transferring money from individuals to merchants for purchases carries a 1% fee per transaction, deducted from the merchant only, bill payments 0.15 dinar, cardless withdrawal 0.75 dinar per 100 dinars maximum. Balance inquiry, electronic statements, local and international card management via the app (request–stop–activate), and instant payments are all free.