Salaries: Between the Scourge of Corruption and the Demands of Need

Dr. Abdul Salam Nasia, an economist, wrote an article titled: Salaries: Between the Scourge of Corruption and the Demands of Need.

A salary is the material representation of the effort exerted by a worker or employee, typically determined according to the principle of “payment for work.”

Most countries establish minimum wage thresholds, whether for a specific task or hourly work, especially in the private sector. This approach grants employers the freedom to determine the nature and required hours of work, shaping what is known as the labor market. In all cases, countries aim to make compensation for work a tool for ensuring a decent living for individuals, preserving social hierarchy, national security, and promoting social justice.

In many countries, except for Arab oil-exporting nations, the government’s role in the labor market is minimal, confined to a limited number of public sector workers. The private sector is expected to absorb most of the workforce. State interventions are typically limited to offering allowances to job seekers until they secure suitable employment opportunities.

Conversely, in most oil-rich Arab countries, the state dominates the labor market, with the private sector playing a limited or negligible role.

Libya is one such country where the state reigns supreme in the labor market. There have been periods where the private sector was entirely absent, making the state the sole employer. This condition has led to an enormous inflation of the salary bill in terms of both size and value, negatively impacting resources allocated for development programs and projects, and causing delays in salary disbursements.

The issue of delayed salary payments in Libya is a chronic problem that has persisted for many years and is not merely a product of current circumstances. This issue has manifested in various forms over time, and its causes can be categorized into two primary groups.

The first group includes chronic causes, such as the marginalization of the private sector, leading to an increase in workforce concentration in the public sector. This overburdened the state budget. Additionally, the country’s reliance on a single income source—oil—makes it vulnerable to fluctuations in prices and quantities, directly affecting the state’s income and, consequently, the value and timing of salary payments.

The second group of causes emerged in recent years, highlighting the private sector’s weak ability to meet market demands and attract workers due to a lack of confidence in it and the higher salaries offered in the public sector. Furthermore, arbitrary salary increases and extensive public-sector hiring, driven by competition between governments and individuals to secure loyalty, have exacerbated the issue. This situation is compounded by currency depreciation due to institutional spending and increased government expenditure during periods of institutional division.

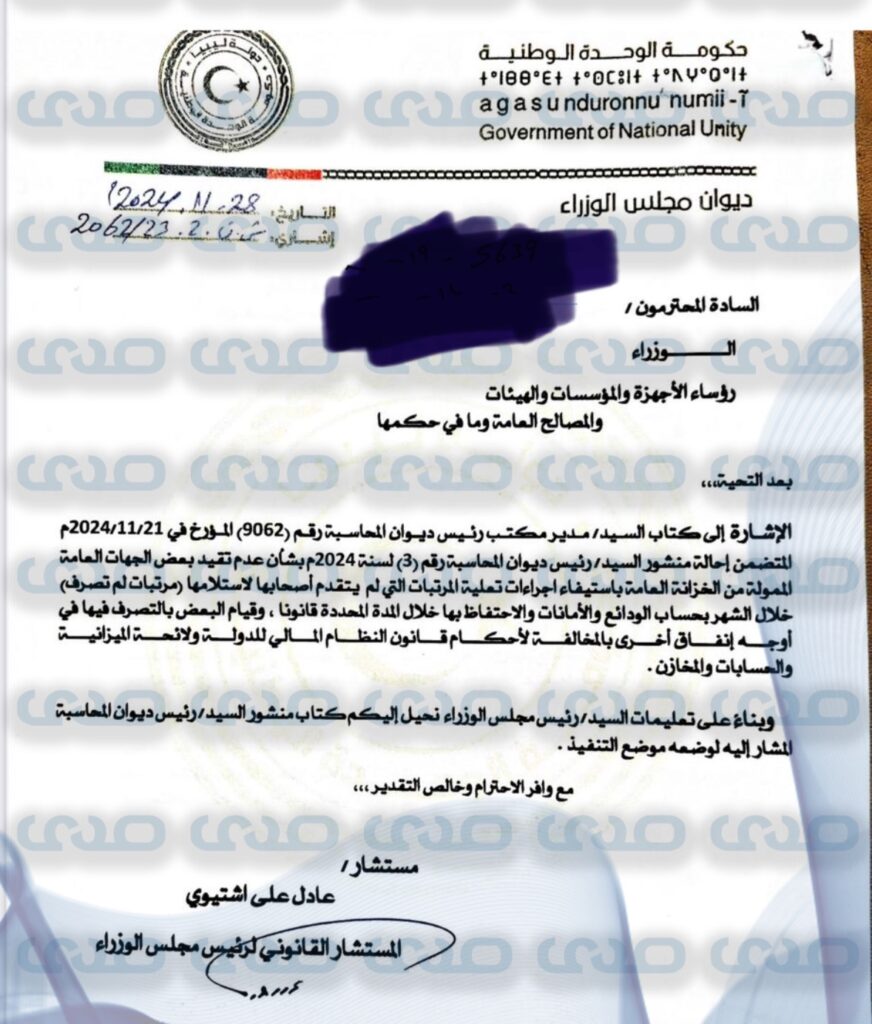

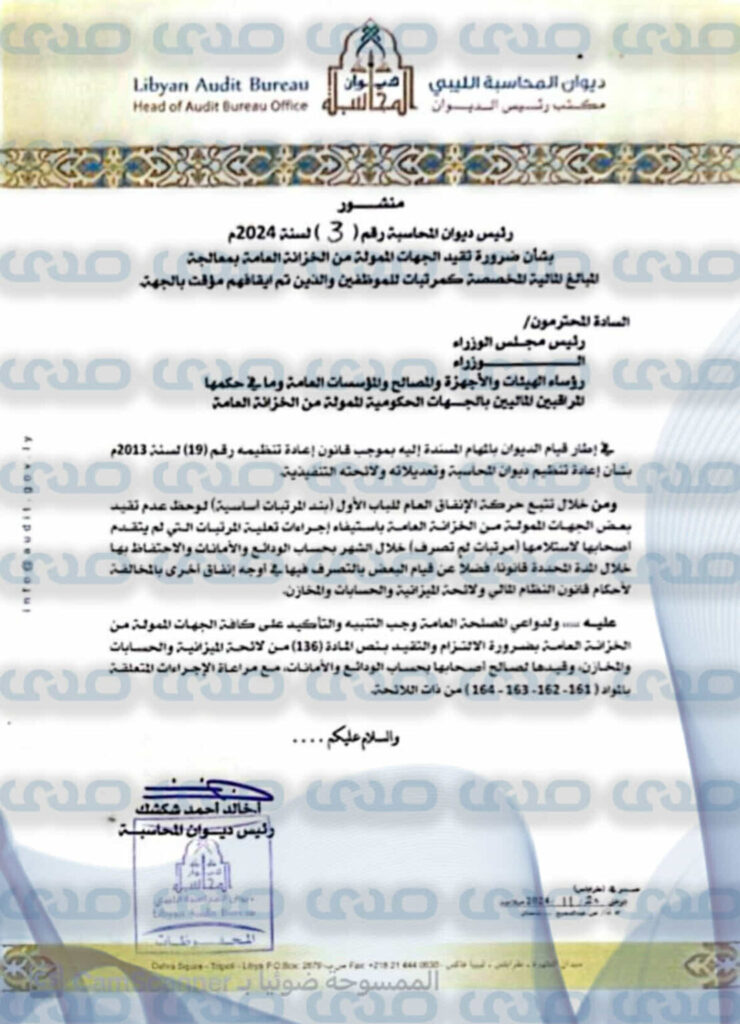

The state has recently witnessed a significant increase in the number of employees, raising the salary bill to more than 65% of the country’s total income. Unusual financial policies have also surfaced, such as “salary adjustments,” which are marred by widespread corruption. Additionally, dual employment and irregular revenue collection practices, including the National Oil Corporation withholding and mismanaging revenue, have further aggravated the situation.

Addressing this crisis has become a pressing priority for financial reform, particularly given the grim outlook for declining oil prices. Any delay in tackling this issue could deepen the economic and social crises the country is facing.