| News

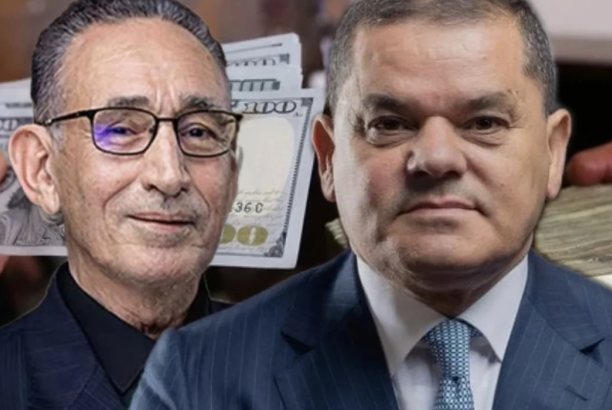

Exclusive: Husni Bey Comments on Central Bank and NOC Statement as a Wake-Up Call, and Questions the Appropriate Exchange Rate to Avoid Budget Deficit

Libyan businessman Husni Bey told our source: “Through following the page The Economic Salon, which is a non-governmental organization and civil society entity focused on economic matters, and observing the discussions, reactions, and critiques of the circulars issued by the Central Bank of Libya (CBL), it’s clear we are hearing alarm bells.”

He added:

“The response from the National Oil Corporation (NOC) attributing the low revenues in 2024 to several reasons includes:

- Oil shutdowns due to political issues.

- Rising fuel costs and exchange agreements.

- The lack of a budget representing fuel and energy allocations.”

Husni Bey commented with numerical analysis, stating: “The CBL’s circular and the NOC’s response regarding the reasons for the decline in cash flows from oil sales represent a wake-up call or an opportunity to raise public awareness and demand change.”

He further said: “There is no disagreement that deep distortions threaten Libya and its people, as reflected in the growing fuel bill, according to the NOC’s statement, especially after the adoption of barter programs since 2020 and earlier.”

Continuing, he noted: “The Central Bank sounds the alarm, and the NOC issues warnings; both are correct from their respective perspectives. The root cause of what is happening is the failure of the House of Representatives and the Government of National Unity to approve a budget that includes all revenue and expenditure items, covering total oil production and expenditures, including fuel and energy. The government must present a budget, and the House of Representatives must approve one that sets limits on government spending.”

He emphasized: “Expenditures, in any form, must not exceed total revenues from all sources. In my view, resistance to changing the mechanism and system of energy and fuel subsidies, which consume 38% of Libya’s oil production share after deducting the 12% share of foreign companies, is a priority for any attempt at fiscal reform.”

He added: “Our mindset as Libyans calls for change, but our hearts insist on maintaining the status quo—even as the purchasing power of the dinar collapses, inflation rises, and subsidies are stolen or smuggled. Strangely, we all aspire to and demand better results and different outcomes using the same inputs and mechanisms unchanged for 50 years. We even reject changes, starting with substituting subsidies with cash to achieve fair distribution. We fail to recognize that the fuel bill approaches $14 billion, costing each Libyan family about $12,000 annually or 5,500 LYD monthly.”

Husni Bey continued: “It was a general shock when the NOC transferred $500 million to the government’s account at the Central Bank compared to the significantly higher dollar sales made by the Central Bank. Everyone is asking, ‘What’s going on?’ Personally, I believe the only change is the rising fuel bill, which reduces net dollar revenues transferred to the CBL. The explanation in numbers is as follows:

- The $500 million transferred by the NOC covers oil sales for only eight days.

- If the transfer continues at the same value ($500 million every eight days), the total annual amount transferred by the NOC would approximate $22.8 billion in 2025.

- Monthly transfers of $1.9 billion by the NOC to the CBL do not include fuel and energy costs.

- Fuel and energy barter agreements internally amount to $375 million monthly ($4.5 billion annually) or 12% of Libya’s oil and gas production share.

- Monthly transfers of $1.9 billion from the NOC to the CBL exclude $750 million monthly for barter and fuel and energy agreements, totaling $9 billion annually or 25% of Libya’s oil production share.”

He summarized: “Libya’s annual oil and gas revenues amount to $36.3 billion, distributed as follows:

- $22.8 billion transferred to the CBL.

- $4.5 billion for local and external fuel and gas barter agreements.

- $9.0 billion for external oil and gas barter agreements.”

Husni Bey posed critical questions:

- “Do we accept that $13.5 billion (37.3% of Libya’s share) is wasted through excessive consumption, legitimized theft, and smuggling?

- Does the monthly $1.9 billion or annual $22.8 billion suffice to cover 93% of the remaining public expenditure after subsidy costs, at an exchange rate of 4.850, 5.500, or 6.000?

- What is the appropriate exchange rate that should be adopted to prevent the budget from being financed by deficits, thus avoiding further collapse?”