| Reports

Who protects officials’ pockets and drains citizens’ wallets? The story of taxes that disrupted the market and sparked anger!

In a country groaning under rising prices and collapsing purchasing power, tax decisions no longer appear to be an economic solution. Instead, they have become a new symbol of chaos and contradictio…

More reports

Sponsored ads

Al-Farsi: “Libya 2026… An Oil Trap or an Opportunity for Reform?!”

Economics professor Ayoub Al-Farsi wrote an article in which he stated: Libya 2026… An Oil Trap or an Opportunity for Reform?! The beginning of the old–new wager is tied to the global energy market, which has shaped Libya’s economic landscape for decades. With expectations of an increase in oil supply in 2026 due to higher production from countries outside OPEC+, a downward trend in pr…

Corruption Files

-

Collapse of the Dinar and Rising Prices Precede Al-Huwaij’s “Awakening” Ahead of Cabinet Formation

Collapse of the Dinar and Rising Prices Precede Al-Huwaij’s “Awakening” Ahead of Cabinet Formation -

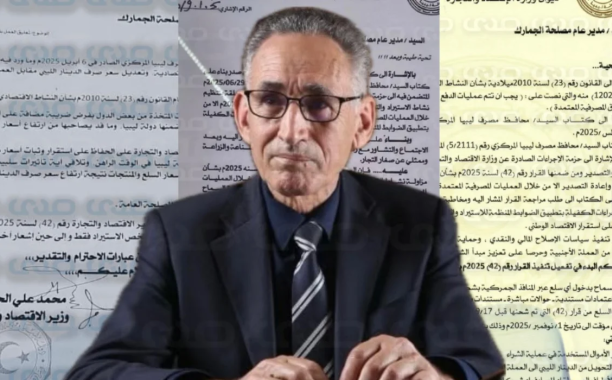

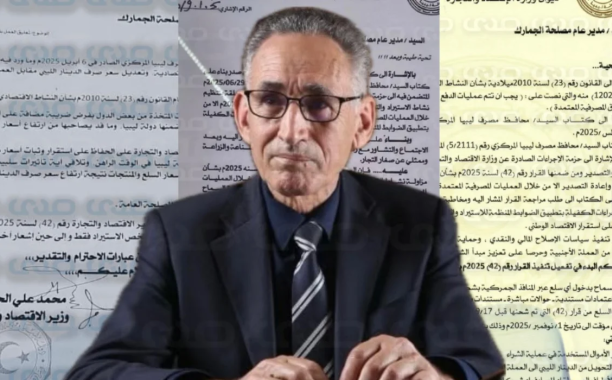

From Decision to Its Opposite… Al-Huwaij Reinforces the Image of the Confused Minister!

From Decision to Its Opposite… Al-Huwaij Reinforces the Image of the Confused Minister! -

Exclusive: With Documents… Corruption of Abdullah Gaderbouh, Head of the Administrative Control Authority

Exclusive: With Documents… Corruption of Abdullah Gaderbouh, Head of the Administrative Control Authority -

Exclusive.. Sources reveal: Sensitive powers leave the Ministry of Economy by decision of Al-Huwaij

Exclusive.. Sources reveal: Sensitive powers leave the Ministry of Economy by decision of Al-Huwaij -

Exclusive: Al-Huwaij’s Regulations Ignite Public Outrage and Disrupt the Market

Exclusive: Al-Huwaij’s Regulations Ignite Public Outrage and Disrupt the Market

| News

Al-Aswad: “This is how Libya’s image becomes inappropriate abroad”

The Vice President of the European Union Program to Support the Private Sector in Libya, Mohamed Al-Aswad told our source: “There is an indicator related to the economy, which is the indicator of lo…

More coverge

Corruption Files

Collapse of the Dinar and Rising Prices Precede Al-Huwaij’s “Awakening” Ahead of Cabinet Formation

After backtracking on the decision to restrict import and export operations to banking channels, Mohammed Al-Huwaij has…

From Decision to Its Opposite… Al-Huwaij Reinforces the Image of the Confused Minister!

In a scene that exposes the state of administrative chaos, Libya’s Minister of Economy in the Government of National Un…

Exclusive: With Documents… Corruption of Abdullah Gaderbouh, Head of the Administrative Control Authority

Our souce has exclusively obtained critical documents exposing the involvement of Abdullah Gaderbouh, Head of the Admin…

Exclusive.. Sources reveal: Sensitive powers leave the Ministry of Economy by decision of Al-Huwaij

Exclusive sources told our source that the Minister of Economy in the Government of National Unity, Mohamed Al-Huwaij…

Collapse of the Dinar and Rising Prices Precede Al-Huwaij’s “Awakening” Ahead of Cabinet Formation

From Decision to Its Opposite… Al-Huwaij Reinforces the Image of the Confused Minister!

In a scene that exposes the state of administrative chaos, Libya’s Minister of Economy in the Government of National Unity, Mohamed Al-Huwaij, shifts back and forth between issuing decisions, withdr…

Exclusive: With Documents… Corruption of Abdullah Gaderbouh, Head of the Administrative Control Authority

Our souce has exclusively obtained critical documents exposing the involvement of Abdullah Gaderbouh, Head of the Administrative Control Authority, in financial corruption allegations.

The docume…

Exclusive.. Sources reveal: Sensitive powers leave the Ministry of Economy by decision of Al-Huwaij

Exclusive sources told our source that the Minister of Economy in the Government of National Unity, Mohamed Al-Huwaij, decided to transfer part of the ministry’s powers to a committee comprising fig…

Who protects officials’ pockets and drains citizens’ wallets? The story of taxes that disrupted the market and sparked anger!

February 24, 2026

In a country groaning under rising prices and collapsing purchasing power, tax decisions no longer appear to be an economic solution. Instead, they have become a new symbol of chaos and contradiction in the management of public finances.

Amid conflicting statements, decisions passed behind clos…