Exclusive: For These Reasons… Shakshak Urges Dbeibeh Not to Take Any Measures to Implement His Decision to Cancel 25 Embassies and Diplomatic Missions Abroad

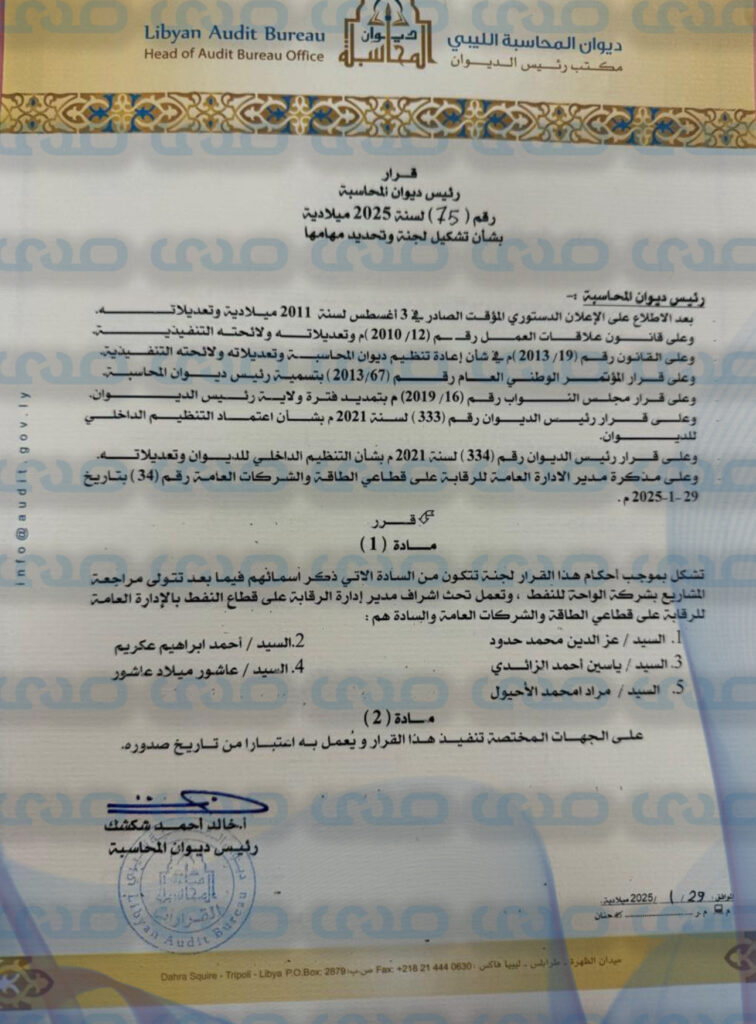

Our source has exclusively obtained a letter from the President of the Audit Bureau, Khaled Shakshak, addressed to the Prime Minister of the Government of National Unity, Abdul Hamid Dbeibeh, urging him not to take any measures that would implement the decision to cancel 25 embassies and diplomatic missions abroad and merge them with other missions. This recommendation is based on the Bureau’s jurisdiction and in accordance with Law No. (19) of 2013 concerning its reorganization and the follow-up and execution of the observations included in the Bureau’s reports.

Shakshak explained that, based on the documents submitted to implement the said decision and to achieve the intended objectives efficiently and effectively, the Bureau recommends a comprehensive review before taking any measures or execution procedures. He emphasized that diplomatic missions abroad, as well as the Deputy Minister of Foreign Affairs for Consular, International Cooperation, or Political Affairs, should refrain from taking any steps to implement or amend the decision or issue any executive orders until the following issues are fulfilled:

- Review the financial, staffing, legal, political, sovereign, organizational, administrative, and procedural status of the missions proposed for cancellation, merger, or retention.

- Inventory and evaluation of assets and properties such as vehicles, buildings, equipment and furnishings, administrative and diplomatic archives, financial records, entrusted assets, electronic devices, phones, and international numbers, etc.

- Inventory and evaluation of human resources, including local staff, attachés, and advisors, with a clear determination of their salaries, benefits, entitlements, insurances, debts, and employment rights.

Once the above issues are addressed, employees from closed missions must be reassigned to other missions and their employment status handled properly, including contract terminations. Lease agreements, partnerships, guarantees, and contractual obligations should be reviewed, as well as the legal standing of the closed missions to ensure there are no legal impediments to their closure.

It is also essential to preserve classified archives and documents by legal means and to provide an implementation mechanism that ensures the diplomatic staff’s rights during their transition to new workplaces. Ongoing legal disputes raised by diplomatic staff in this regard must also be addressed. A comprehensive file for each closed diplomatic mission should be prepared, detailing its financial, administrative, and legal status, as well as the condition of the building, debts, entrusted assets, dues, and international subscriptions.

Additionally, merged missions must be reviewed, including diplomatic agreements with host countries concerning the status of missions, and host countries should be notified of the closure of diplomatic missions in accordance with legal protocols and international norms.