An exclusive press interview for Sada Economic Newspaper with Mr Abdul Monsef Mahmoud Al-Shalawi, Senior Advisor for Strategic Projects and Agreements, Chairman of the Board of Directors of the National Oil Corporation – and a member of the negotiation committee with Eni and representative of the Corporation.

1- As an advisor to the head of the National Oil Corporation, can you give the readers an overview of the oil and gas sector in Libya?

“First of all, I would like to greet you, and ladies and gentlemen readers. It is a pleasure to be with you today to answer questions that may arise from the Libyan citizen. We ask God to be successful in answering clearly and explicitly.

In fact, the issuance of the Oil Law, in the year 1955, and the export of the first shipment of oil from the Sidra oil port, in the year 1959, caused the transfer of the Libyan state, from the poorest country in the world, during the fifties, to one of the richest countries in Africa, and the discovery of oil was a reason In achieving comprehensive development, and achieving a clear shift in economic life and its social outputs.

However, due to the lack of the necessary expertise to run the oil sector in that period, and given that the contracts necessary to exploit the prevailing oil wealth in that period, which were known as concession contracts, gave full control to the oil companies, as the state’s exercise of its sovereignty over its oil wealth was represented by imposing taxes and royalties. However, with the beginning of the year 1970, and the establishment of the National Oil Corporation, the situation changed, in terms of the state’s exercise of sovereignty over its oil wealth, so the state became represented within the oil companies, through membership in the boards of directors of participating companies, and the national component became entitled to take the decision in terms of the amount of production or controlling expenses. The most important thing is that the oil wealth in the ground has actually become the property of the Libyan state.

The seventies of the last century were marked by the nationalization of the sector, as 51% of the shares of Esso Standard, the Libyan American Petroleum Company, Shell Exploration and Production, Mobil Oil Libya, Gelsenberg Libya, California Oil Company, and other companies were nationalized. The main reason for the nationalization process is to achieve state control over the oil wealth management operations, from exploration to production to sale. It is worth saying that production during the early seventies reached 3 million barrels per day.

As for during the eighties and nineties, the main feature of the sector was the exit of all American companies, and the blockade on the supply of spare parts and technology related to the development of the sector. Therefore exploration and development activities decreased sharply, and the biggest negative impact was the development of the manufacturing and petrochemical sector.”

2- Mr. Counselor, terms are often used by oil and gas specialists to express oil contracts, such as: EPSA, DPSA, and other terms that may seem ambiguous to the reader. Can you explain what is meant by these terms?

“To answer this question, it is assumed to go back to the period of oil discovery in the developing or newly liberated countries during the fifties, so the so-called concessions appeared. This type of contract is an imported contract from the United States of America, giving the world’s oil companies (in particular in that period), the right to fully control the exploitation of oil wealth, and the state exercises its sovereignty over oil wealth through taxation.”

Al-Shalawi continued by saying: “Developing countries were forced into this type of contract due to lack of experience, severe poverty, and the need of these countries, including Libya, for a source to finance the development process, and at any price. However, with the beginning of the sixties, the so-called Production Sharing Agreements (PSA) were developed. It spread in most oil-producing countries, and moved to Libya in the early seventies, and it was known as (EPSA), and it can be abbreviated as its working mechanisms, that the host country moves away from the risks related to exploration, and it is borne by the oil company. If oil is found, it is shared between the state and the oil company, in predetermined proportions. If no oil is found, the oil company bears alone the expenses of exploration.

As for the production-sharing development contracts (DPSA), they are, in short, related to explored areas. The state needs an investor to contribute to its development process. There are some other contracts, even their use is limited, which is the state’s use of a service company to carry out exploration, development and production operations, which is what is known as service contracts, so that a contract is made to pay a certain value for each barrel that is produced, or a monthly amount, or a percentage of the quantities of oil produced.”

3- What about oil contracts in Libya?

Al-Shalawi also pointed out that “the Oil Law spoke explicitly and defined the relationship between the state and the oil companies, through the previously mentioned concession contracts. The relationship between the state (the National Oil Corporation) and the companies were regulated through production-sharing agreements(PSA), which were known in Libya as exploration and production-sharing agreements (EPSA), and they evolved from EPSA-1 in the early seventies to EPSA-2 in the late 1970s, to EPSA-3 during the 1980s and 1990s, to EPSA-4 during the 2000s.”

4- Mr. Counselor, there is a question that may arise and may come to the mind of the reader: why did the EPSA contracts develop in Libya? Are they different agreements or an amendment to previous agreements?

He stated: “First, we are supposed to point out that the oil contracts and the percentages granted to the investor are governed by several factors, including economic, political, and competitive. When the Libyan state transformed from concession contracts to EPSA-1 contracts, the main objective from the point of view of the legislator was political and economic, which is the imposition of state control over its oil wealth, and obtain more benefits. Thus issued the nationalization law, then it developed into EPSA-2, after the year 1973. The main reason is purely economic, as oil prices rose by no less than 300% due to the war in 1973, and thus the state saw that the share of the state should be increased, and the agreements were amended on this basis. During the eighties and during the siege, the Libyan state was forced to make amendments to the contracts to attract international oil companies. It is worth noting that the Libyan state introduced during that period what is known as the principle of “refund Exploration costs”, hence the emergence of what is known as EPSA-3 contracts.”

Al-Shalawi said: “During the 2000s, the EPSA contracts were amended, and the fourth generation of these contracts, EPSA-4, appeared, which is a natural evolution of the previous contracts, and was designed at a time when the state was thirsty for exploration activities in the sector after years of hiatus. It should be noted that the state When developing EPSA-4, it had huge quantities of hard currencies and the funds needed to meet any investment that the corporation might conclude, and what distinguishes the fourth generation of contracts is its transparency in terms of the offering, but its risks appear in two cases: the first is in the event of a drop in oil prices Below 45 dollars, at this level of prices, the feasibility of exploration and development for companies will not be feasible, and therefore companies, especially small ones, will procrastinate in exploration operations, and the second case, when the government does not have sufficient funds to implement its contractual obligations, (granting the investment budget to the institution National Oil Company), to carry out development operations, which is exactly what the government and the Corporation are facing in the current period.

I will give you an example to illustrate this: suppose that the National Oil Corporation signed an EPSA-4 contract with Company X, in a specific oil block, with a participation rate of 70% in favor of the state and 30% in favor of Company X.”

Al-Shalawi continued, saying: “This company is obligated to carry out searches and exploration of the granted area, for a period predetermined in the contract, and the company has spent 500 million dollars. Exploration, but if oil is found, the relationship moves to a second stage, so that an operating company is established, and this discovery is developed, and let us assume that the development costs are one billion dollars, then the company will spend 50% and the institution 50%, and “exploration costs will be recovered.” spent by the company, according to a percentage specified in the agreement, amounting to 40% in most cases.

Next, we come to the stage of operating expenditure, which is the sums incurred by the operator company for the conduct of its business (salaries, maintenance, drilling, etc.), and these operating expenses are distributed according to the participation rate that we referred to earlier and specified in the EPSA-4 contract, 70% to be borne by the corporation and 30% shall be borne by the company, and the percentage of oil production shall be distributed in the same proportion.

This is only one example, and the reader can estimate the amount of money that the state (the National Oil Corporation) will incur if all the oil discoveries committed to by the National Oil Corporation are developed, which are estimated in dozens.”

5- Who is responsible for amending the agreements? Is it the establishment? Or the Ministry of Oil? Parliament?

Al-Shalawi said: “The National Oil Corporation was established according to Law No. 24 of 1970 AD, as it was entrusted with the responsibility of managing the oil sector, and it was later reorganized according to the decision of the General Secretariat of the General People’s Congress (formerly) No. 10 of 1979 AD to work to achieve the goals of the transformation plan in Oil fields, and to support the national economy through the development and development of oil reserves and their optimal exploitation, management and investment to achieve the best returns, and it may participate in this with the bodies, institutions and other bodies that carry out work similar to its work.

Because it is the government arm that is technically and professionally closest to the oil and gas market and the various economic influences, it is the one that conducts the necessary studies to propose any amendment to or development of agreements, in a manner that guarantees the continuity of oil operations in the country and the optimal investment of oil wealth.

During the 1970s, 1980s, and 1990s, the Corporation proposed the necessary amendments and submitted them to the government, the latest of which was the Higher Committee for Negotiations during the year 2007 AD, through which the agreements of several companies were amended to shift from previous contracting patterns to EPSA-4.

We must emphasize that the Foundation is only a technical professional body that submits a proposal for amendment to the government, and it has the right to approve or reject it, or to renegotiate with companies to achieve the best interest of the Libyan state.”

6- Can you give us examples of previous amendments to the IBSA contracts, which were previously carried out by the Corporation?

Al-Shalawi informed us by saying: “In fact, the shift from concession contracts to IBSA contracts came in accordance with the nationalization laws, and as for what followed, they were all amendments made by the institution, and were presented to the government for approval, whether the prime minister or a general popular committee, the amendment that was made The NOC based on EPSA-1, even if it was simple, led to EPSA-2, as well as the amendment made by the National Oil Corporation, which granted companies the right to recover costs, which led to EPSA-3, and these are all amendments that the NOC made and presented. To the Prime Ministry for approval, approval was given in particular, as is the case for EPSA-4 contracts.

Here it should be noted that during the year 2007, the Board of Directors of the National Oil Corporation formed a higher committee to negotiate with companies regarding their conversion to the EPSA-4 contracting pattern. Eni Oil Company was granted the right to exploit producing oil areas, despite the expiry of these contracts. It is possible for the Libyan state to control these areas by 100%, but the National Oil Corporation considered that it is in the interest of the sector to continue the partnership with Eni in these areas, and the amendment was presented to the General People’s Committee and granted permission to amend, despite the opposition of the General People’s Congress (Parliament in that period).”

7- We come here to the agreement of the National Oil Corporation and Eni, which was signed recently. Why was all this controversy raised about it? And why do you think that the Ministry of Oil, represented by the minister, opposes this agreement?

“My dear sister, there are some facts that the reader is supposed to know in order for the picture to become clear to him, and he does not listen to some means of communication that we do not know the extent of their credibility. Through my experience that exceeds 36 years in the sector, I would like to explain to the reader some facts:

First: The National Oil Corporation is the technical and professional body that the legislator has entrusted with the powers and tasks of developing and developing the oil wealth, and is entrusted with it. For more than fifty years, the accumulated experience of the Corporation has the ability and competence to determine the interest of the Libyan state and to negotiate professionally to achieve this interest.

Second: The EPSA agreements, in their various forms, explicitly stipulate that the partnership between the Libyan state and the partner should be fair and just.

Third: Eni has been a partner of the Libyan state for more than fifty years, and it has positions that should not be forgotten. It stood with the Libyan state during the blockade, and is one of the most invested companies in the Libyan oil sector. The Italian state has common interests with Libya, and Libya’s partner in the only gas pipeline. Which connects Libya to Europe, and is managed by a joint Libyan-Italian company.

Fourth: This offshore oil discovery (forms A & E) was discovered since the end of the seventies, and the reserves were determined and announced commercially in 2013 AD, and no decision was taken regarding their development.

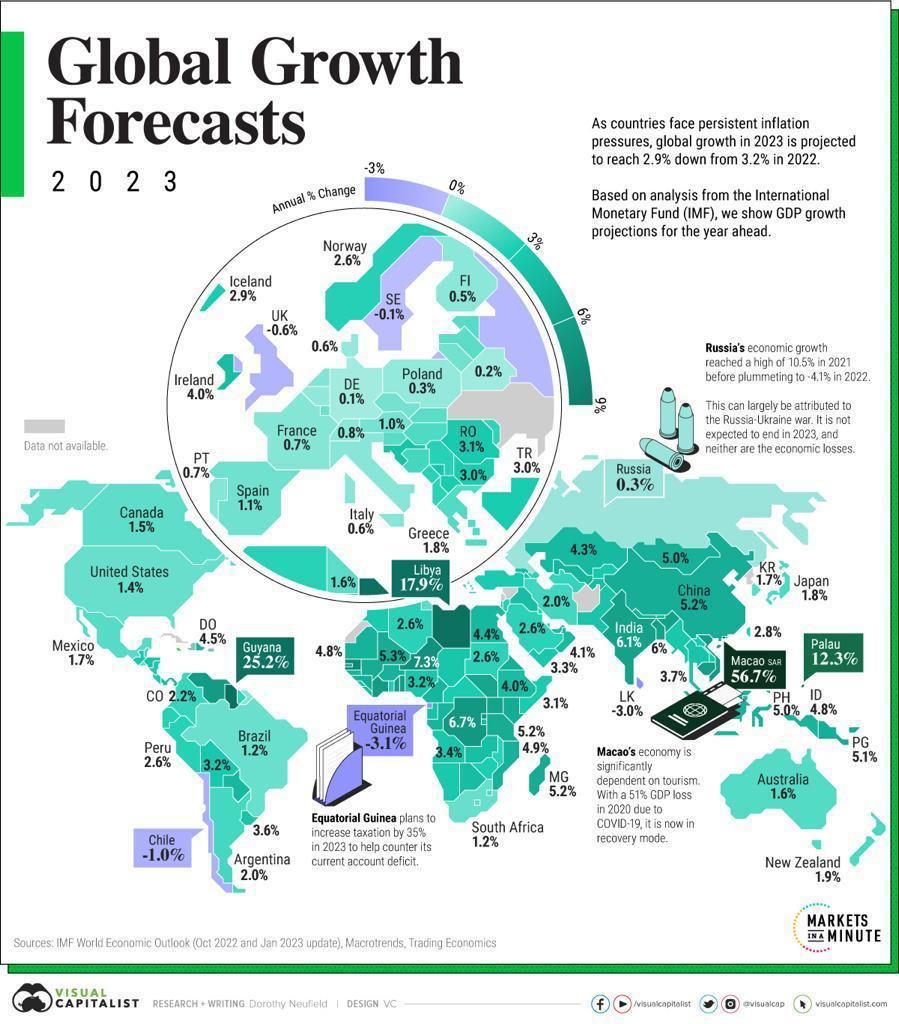

Fifth: The Mediterranean basin region, after the year 2011 AD, became a workshop, so gas fields were discovered in the Zionist entity during the year 2011 AD, Cyprus in the year 2013 AD, and Egypt in the year 2015 AD, and these countries became gas exporters and surpassed Libya in this field.

Sixth: The Greek state has, since 2011, expanded its marine exploration activities, the latest of which was the signing of an agreement with ExxonMobil for exploration southwest of Crete, which threatens the exclusive marine areas of the Libyan state.

Seventh: Most of the state’s indicators internationally are negative, in terms of investment risks, corruption indicators, safety indicators, or indicators of transparency and doing business, not to mention the financial situation that is reflected in the state’s general budget, of which more than two-thirds are allocated to salaries and support.

Eighth: The Libyan oil sector has stopped any exploratory activities, in the professional sense, since 2010. Therefore, it has become necessary to revive this sector and encourage the rest of the companies to enter again, especially after the lifting of force majeure.

The reader is supposed to analyze the process of amending the agreement of the National Oil Corporation with Eni, taking into account the previous facts, and in addition to the above points, the corporation has formed a committee of specialists in several fields (law – oil – finance), all of whom are attested to have experience , and sophistication in their fields, and I was part of this committee, and Eni’s request related to amending the “cost recovery ratio” was studied, and raised to 45%, which is the percentage that was previously referred to, and represents the amounts that Eni is entitled to recover at the start of production to recover The costs incurred for the development of the two plots, and the EPSA-4 agreement that was signed with Eni in 2008 stipulates that the cost recovery rate is 40% for a period of 10 years, extended for two years, and then becomes 30%, so the total period is 12 years, ended in 2020 Eni now has the right to either implement the development by 30%, amend it, or request a withdrawal.

The reader may ask, what are the conditions of the Libyan state during the years from 2011 to 2020, is it an attractive environment for oil investment? Did the Libyan state not suffer from continuous conflicts during that period? Didn’t we have two governments, two central banks, and two parliaments? Didn’t ISIS target the National Oil Corporation building and did two employees get martyred in that incident? Didn’t you burn fields and warehouses? Wasn’t the Mellitah Oil Company building targeted by a terrorist bombing by ISIS? Wasn’t the oil export closed for a period of more than two years?

All these incidents were the main reason for NOC announcing force majeure on its operations, and they were considered factors repelling investment, and neither the Corporation nor Eni could implement any development plan, and therefore, with reference to the 2008 agreement, and taking into account these factors, does the National Oil Corporation compel Eni By developing the A&E compositions, with the recovery rate set at the signing of the agreement in 2008, which is 40%, or 30%, considering that the 12-year period ended in 2020, or do we agree to Eni’s claim, at a rate of 45% as a cost recovery rate?

In order to answer these questions and reach a fair percentage, the Technical Committee, to which we referred earlier, was formed by the Board of Directors of the National Oil Corporation, considering that this is purely professional work and requires different professional specializations. This committee worked professionally and took into account the arguments put forward by the National Oil Corporation. Eni, which is that the investment cost, which was previously decided at $5 billion, has risen to $9 billion, and that the percentage of lending that Eni needs to implement this project has increased, given that Libya is a high-risk country. What the committee did can be summarized by studying all the economic factors affecting Eni’s investment in this piece, according to what was stipulated in the agreement, and it can be detailed as follows:

1- The agreement, signed in 2008, expressly states that the investor (Eni Company) shall be granted a fair percentage of the investments that he spends.

2- The declaration of force majeure by the Libyan state was one of the main reasons that prevented Eni from starting to implement its obligations, as well as the Corporation.

3- Most of the prices of materials needed to carry out the development process have increased significantly, according to price bulletins from specialized institutions. The main component of the project, which is steel, has increased by no less than 300%, contractors’ prices have increased by no less than 30%, and insurance has increased by no less than 30%. About 30%, and the risk premium for lending from international banks for any project in Libya is not less than 6% (if we assume that the bank will lend Eni to a project in Greece at 10% interest, then it will lend it at 16% interest if the project is in Libya), in addition to Freight rates increased by no less than 500%, and in general, the cost of the project increased by no less than 50%, that is, instead of 5 billion, as previously specified, the current cost will not be less than 7.5 billion.

4- Several scenarios were conducted for oil and gas prices, which are supposed to be taken into account in order to reach the necessary financial indicators to determine the recovery rate and the fair share of Eni, and the average oil prices were calculated for a period of 25 years.

5- The most important financial indicators used in the oil and gas industry were calculated, namely: the net present value of the investment, the internal rate of return (return on investment), and the return per invested dollar index (profitability index).

6- The committee concluded that at a recovery rate of 30%, in all scenarios, and even at an investment cost of 5 billion, Eni will not achieve any profit except in the event of a discount rate (interest rate) of 10%, either when the investment cost exceeds 5 billion, or If the interest is higher than 10%, Eni will not achieve any profit, and therefore the committee concluded that the negotiating percentage that the corporation’s board of directors is supposed to negotiate within should not be less than 38%, which was recommended by the committee, and presented by the corporation’s board of directors to the government and approved by it in turn.

7- It is worth noting that, in addition to the amounts that Eni will spend, it is obligated, according to the amendment, to contribute $100 million to sustainable development, $200 million to expenditures on existing oil projects, and $800 million to the Mellitah complex for maintenance, overhaul and development.

8- Mr. Counselor, there is a question that was raised by some media professionals, which is that the state of Egypt did not spend any sums and obtained additional conditions and investments, better than what it obtained from the Libyan state, upon signing the Eni contract, what is your response to that?

Thank you for asking, because it reminded me of one of the important factors that the Board of Directors took into account when approving the amendment – which is clearly: that Libya is no longer the only one in the Mediterranean region, and that we must attract companies and provide them with an environment that helps them invest in a way that achieves profitability.”

He emphasized by saying: “We return to the State of Egypt and take the Egyptian Al-Zahr gas field, which is considered the largest ever in the region in terms of production and reserves, and my answer is: It is true that the Egyptian state did not pay any amount in the investment process, and that Eni undertook the total amount of exploration and development, but there is A fact that may be absent from many, which is that the cost recovery rate granted to Eni is 100%, meaning that the Egyptian state has waived all of its shares to Eni until all its expenses, which amounted to $12 billion, are recovered, in addition to that the Egyptian state will buy gas from Eni company with a 15% discount until all its investment expenses are recovered. As for saying that Eni built a urea plant, gas treatment, etc., these are investments of Eni, in which it owns the majority, and it was not granted free of charge to the Egyptian state.

In addition, we are supposed to point out that the Egyptian state recently discovered the offshore Narges field, and the Egyptian state’s participation rate is only 10%, while Eni’s share is 45% and Chevron’s is 45%. On the other hand, the Greek state granted ExxonMobil 75% of the share Production in its recently signed contract for oil and gas exploration in the sea southwest of Crete, in addition to a 100% recovery rate.

In this regard and for clarification, I would like to say that each country has its own factors that determine the contracting mechanisms and the distribution of participation rates, and what governs all of this is competition and the extent of the state’s ability to finance its operations. If the Libyan state had sufficient financial capacity, it would have been more appropriate to turn to service contracts. And the development advocated by the Ministry, but the financial situation of the state has completely differed during the current years from what it was before the year 2011, and we must face this fact and work on this basis.

The most important thing is for the reader to know that there is a frantic race to explore energy sources, especially gas in the marine areas, of which Libya takes over large areas, and we must be present and strong, instead of standing idly by, while other countries work to bridge the gap, and take over our traditional shares, in the European market.”

9- Mr. Farhat bin Gdara, Chairman of the National Oil Corporation, indicated that there is an acute shortage of gas supplies during the coming years. Can you explain to the reader what is meant by that?

“Thank you for this important question. The statement of Mr. Chairman of the Board of Directors, and other specialists in the sector, comes through technical reports issued by the sector companies that supply the Electricity Company with energy, especially gas, the most important of which is the Mellitah Oil and Gas Company, as the electricity sector depends greatly on Gas supplies from the Al-Wafa field in particular, and production reports indicate that the rates will decrease by the year 2025, at a rate with which the National Oil Corporation will not be able to cover the demand, and therefore the government will have to import gas to feed the power stations, unless we carry out the development process for the explored pieces, and supply The local market and exporting the rest through the gas pipeline linking Libya and Italy, which is currently operating at only 30% of its capacity.”

10- Many readers ask a question about the NOC’s plan to raise oil production to 2 million barrels. When do you expect to reach this ceiling?

Al-Shalawi said that “raising production requires several factors:

First: the political stability of the state and the neutrality of the oil sector. In this aspect, the NOC and its senior management work with all parties, in order for the sector to be stable and not subject to the attraction of different political parties, so that it works with complete independence and professionalism.

Secondly: It is necessary to have budgets and their continuity on a regular basis. Yes, an exceptional budget has been allocated to the institution for the year 2022, of which only 12% was spent during the period.

Third: Developing a development plan, and this is what has already been done by the senior management of the institution, and in this aspect, comes the technical and professional work of the technical cadres that the institution abounds in, which was approved in the recent period through the meetings of the general assemblies of the institution and its companies in terms of identifying projects Targeted development, implementation plans, and all these projects and their budgets, had been determined by the Corporation and its subsidiaries, and placed within a specific time frame ranging from 3 to 5 years.”

– You mentioned in the media that the year 2023 is the year of the Libyan oil and gas sector par excellence, how is that?

Al-Shalawi informed us in the exclusive interview by saying: “Yes, and this did not come out of nowhere, but I mentioned it and confirmed it, because there is a clear vision for the senior management of the corporation that includes a plan to raise production rates and ways to finance the National Oil Corporation and in order to achieve the necessary and appropriate support for the oil and gas sector in Libya, the past few days presented the features of this forward-looking plan for the stability, support and development of the sector, in order to be able to lift force majeure, reactivate agreements with international companies, and address all the difficulties that the institution faced in the past years.

It is worth noting that this important meeting included the foreign partners and the oil companies affiliated with the Corporation, and in this meeting that took place under the leadership of the Chairman of the Board of Directors of the National Oil Corporation and with the participation of the Governor of the Central Bank of Libya, the President of the Libyan Investment Corporation and a number of members of the Committee for the Execution of the Extraordinary Budget of the National Corporation And the Libyan Foreign Bank and the directors of Libyan banks abroad, the Governor of the Central Bank of Libya announced his clear, complete and unequivocal support that the Central Bank supports the ambitious plans of the Board of Directors of the Corporation, which are directed towards raising production and achieving the aspired goals for it, and this presence will certainly give a boost It is positive for foreign companies and would also accelerate their return to work from within the Libyan state, especially after the Corporation addressed all those companies to lift force majeure, the first and strategic step for the return of life to the Libyan oil and gas sector this year 2023. Therefore, this year will be oil and Libyan gas par excellence, God willing.”

11- Finally, Mr Abdul Monsef, what are the messages that you want to convey through this space to the honorable reader, especially the future of the Libyan oil sector?

“To be honest and to date, and as I know, I would like to put the honorable reader in front of the fact that the sector, God willing, and its current management, is in its best condition, for more than 25 years ago, the sector has not witnessed investments of the size expected for the development of the A&E plot, with Eni, which will pump Amounts of not less than $8 billion, and gas will be provided in an amount of up to 750 million cubic feet per day, which guarantees the continuity of supplying power stations. Libyan market.

I would like to emphasize that the Board of Directors of the Corporation has formed several committees, including what works to attract the necessary investments, to develop the dilapidated infrastructure, especially the systems and lines for transporting crude from the fields to the ports, and also to develop control and follow-up operations for all oil operations from production to export, through the transformation program Digital, in addition to the formation of a national committee to reduce emissions of flare gas, which was wasted for decades, and exploit it economically so that it becomes a tributary to the local economy instead of being a pollutant to the environment of the areas surrounding the fields.

I would like to send a message, through you, to the workers in the oil sector, that the Corporation’s management is working hard to return production to before the year 2011, but rather it has an ambitious plan to raise it to 2 million in the medium term, and this will not be possible except with the intensification of everyone, and that this will reflect positively on them from Where the stability of their living conditions, the opening of local and external training opportunities, and employment opportunities for the rest of our honorable people.

Finally, I cannot help but wish you and your readers success, and end my meeting by quoting the Chairman of the Board of Directors saying that “the oil sector is in safe hands, that life has returned to it again, and that the year 2023 will be the year of the sector par excellence.”

Thank you for hosting me, and may God’s peace, mercy, and blessings be upon you.”